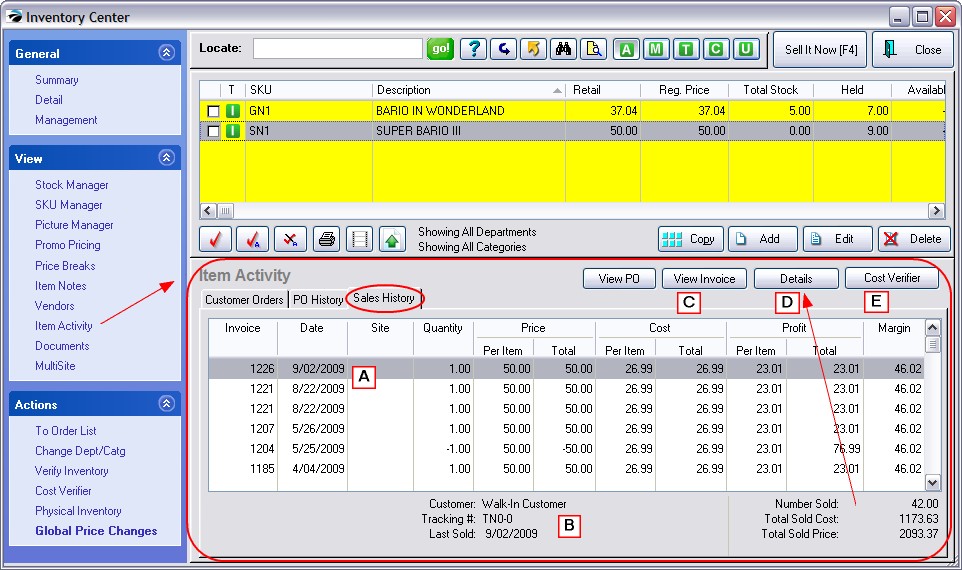

Lists the most recent invoice as the top line.

Shows cost, selling price, and profits per item. If the profit is incorrect, you can adjust the cost value of the item individually or en masse.

(A) Listed in descending sequential order, each invoice displays the date, quantity, cost, price, and profit on the sale.

(B) In the bottom left is a Verify button. If for some reason you question the sales history, the Verify button will double check the status of just this one inventory item sales history.

In the bottom center is the customer name on the invoice and a Tracking Number which can link the item to the original purchase order. By choosing the View PO button at the top center, you can review the actual purchase order.(C) View Invoice - opens Invoice History for detailed review. (see Invoice History)

View PO - opens Purchase Order history of the specific item sold (see Purchase Order History)

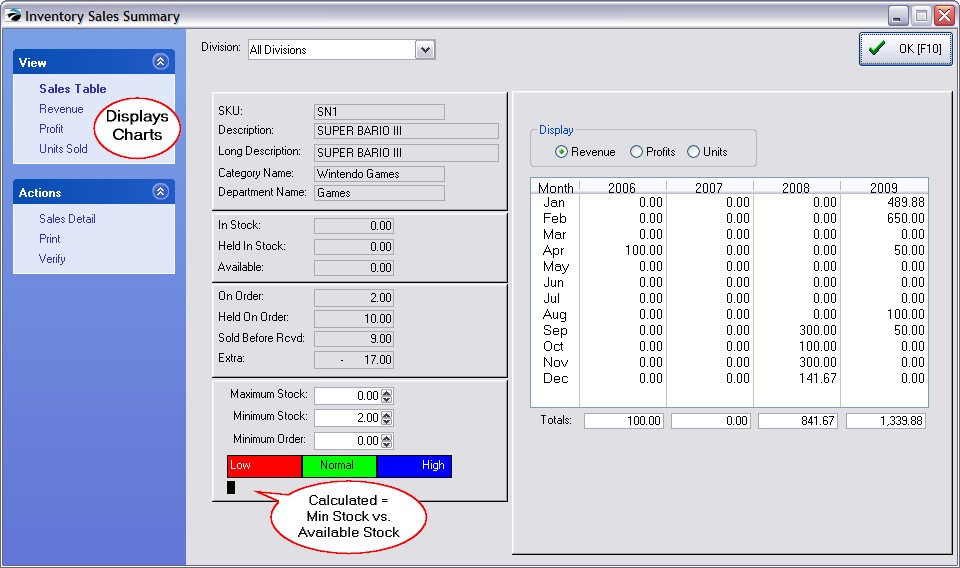

(D) Grand totals of number sold, cost, and selling prices are displayed at the bottom right. In you want to see this information in graphical form and broken down by years, choose the Details button at the top. Then choose a view at the left. (see Inventory Sales Summary)

(E) Cost Verifier is used in the event that costs were not correctly entered when product stock counts were recorded, one can choose to adjust costs of items already sold. (see Adjust Item Cost)

If you determine that a cost was inaccurate, highlight the invoice and change the cost with this Cost Verifier button. This will correct your profit reports.

Correcting Cost on Multiple Invoices Simultaneously

Several invoices can be selected and changed simultaneously. Choose the Details button in the upper right. Then choose Sales Details. (see Adjust Item Cost)

by tagging two or more items, first, and then using Cost Verifier to change all tagged items.

TIP: Highlight the lowest invoice date or number and then choose Tag All button. This will checkmark items sold more recently than the tagged item.

Average Cost - If the invoice sold multiple units which drew upon First In-First Out items with different costs, then cost will be averaged based on FIFO costs of each item sold.