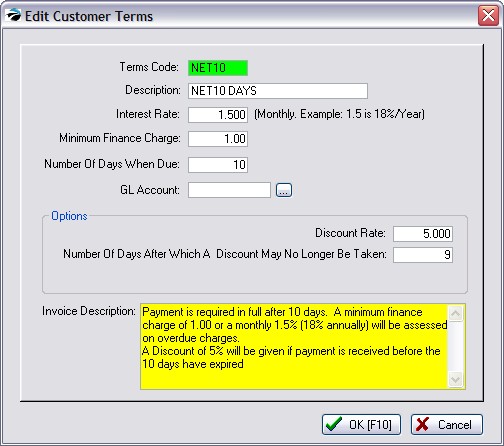

Customer terms determine how the customer is expected to make payment. Type in a code and a description. The code is an abbreviation such as COD for Collect On Delivery. The description line allows you to spell out the term which will be printed on the AR Statement. You will be able to add more terms or edit this information.

At the very least, you should have one Customer Term named COD.

Terms Code - A code of your choosing. Some possibilities are COD, Net15, Net30, Net30F. You may wish to have some terms with and without finance charges. For example Net30 could be without and Net30F could include a finance rate.

Description - A descriptive phrase which will best explain the term.

Interest Rate - The MONTHLY rate of finance charges. For example, enter 1.50 for an 18% annual rate.

Minimum Finance Charge - If you wish to charge a fee for simply maintaining the open store account this minimum amount will be applied if normal finance charges amount to something below this minimum.

Number of Days When Due (After Which An Invoice is Considered Past Due) - A finance charge based upon the interest rate entered above will be applied after this number of days since the invoice was created. You may wish to factor in a grace period. For example, for a five day grace period of a term called Net 15 the number entered here would be 20 days.

GL Account - (optional) you may set a specific GL Account for each customer term

Discount Rate - Enter the percentage of discount which will be automatically applied if payment is made before the cut off period.

Number of Day After Which A Discount May No Longer Be Taken - The cut off period will be in this number of days. It starts from the day the invoice is created.

Invoice Description - Clarifying statement printed on the customer invoice.

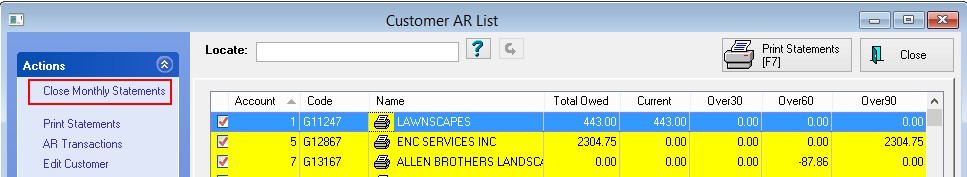

When you process AR Statements (Accounting: AR Statements), the finance charges will be calculated when you choose the Close Monthly Statements button

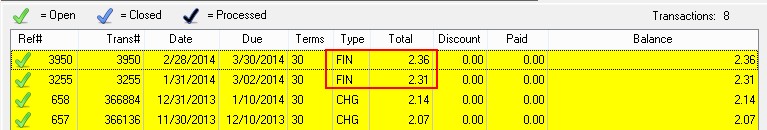

This will create individual FIN entries in the customer's AR Details screen

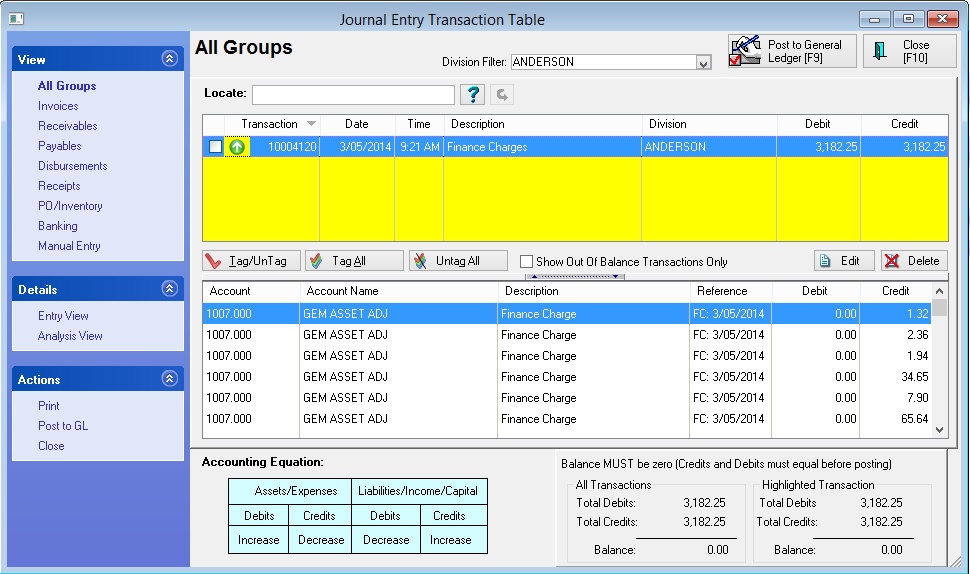

And it will create one consolidated GL Transaction for all of the finance charges for this month.