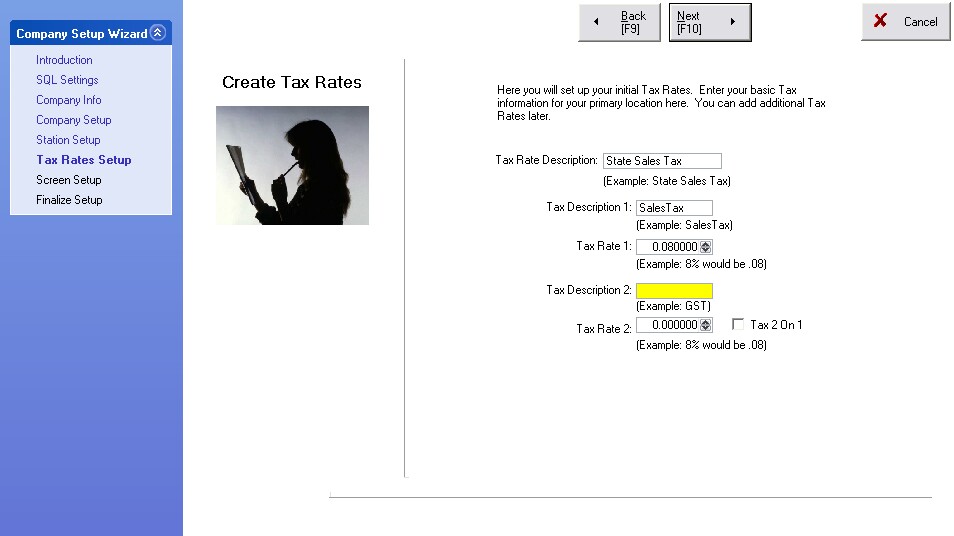

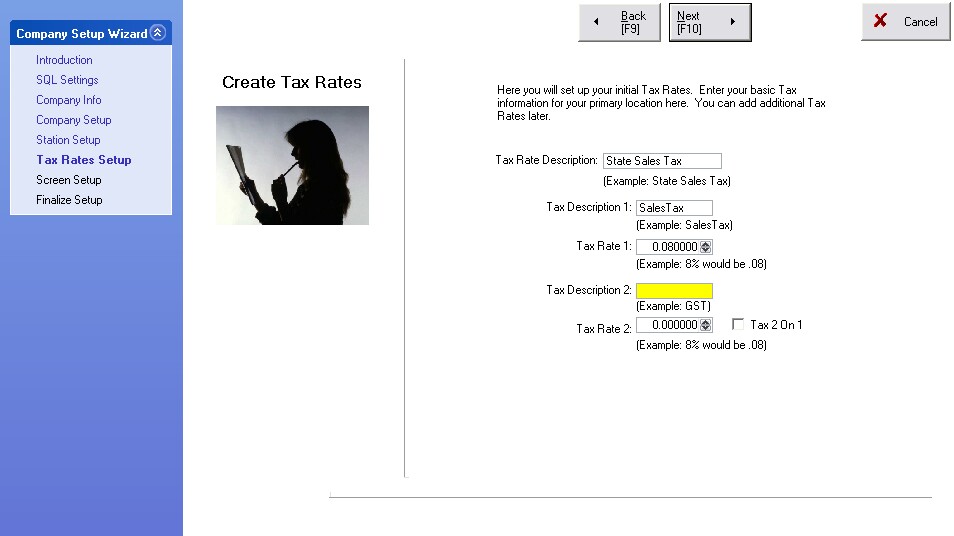

As you first created your company, you were prompted to enter a basic tax.

By default, POSitive then updated three primary areas which control the assessment and reporting of sales taxes. For most businesses, this basic setup will be adequate. However, if you need to make additions or refinements the following general explanations should be helpful. Specifics about the options are explained in designated topics.

Maintenance: System Setup: Tax Options - Controls what happens when at the Invoice Screen. (see POSitive Setup Form, specifically the last section called Tax Options)

| • | Quick Sale Tax Group - sets the tax rate for sales made to walk-in customers |

| • | Package Sales Tax - sets the tax rate for inventory when a mix of inventory items are "packaged together" with one selling price. |

| • | "No Tax" Tax Category - sets the 0.00 tax rate and deploys the CTRL-X override function. |

| • | Activates "Sales Tax Rounding" |

| • | Activates "Base Tax on Invoice Total" instead of calculating tax on line items |

| • | International Settings not typically used in the USA |

| • | Activates options to include the tax in the selling price |

| • | Sets the tax rate to be used when including tax in selling price |

| • | Sets option to display VAT pricing at the inventory screen |

Maintenance: Tax Rates - (see Tax Setup)

| • | Sets all the tax percentage rates |

| • | Defines "Tax Groups" for different kinds of customers who qualify for tax breaks |

| • | Sets the option to use two tax sub totals |

| • | Defines tax rates for various types of inventory which are taxed at different percentages |

| • | Allows for tax charges based on minimum and maximum dollar value of an inventory item or invoice total (see Special Taxation Setup) |

| • | Activates "Base Tax on Invoice Total" instead of calculating tax on line items |

Utilities: Categories - (see Category Detail)

| • | Sets tax rate to be used for inventory items assigned to the category |