| Show/Hide Hidden Text |

There are communities with some very unique taxation rules. Most businesses do not need to know the following information, but we want to share these examples for those who may have a similar situation.

These scenarios represent real situations wherein the taxes changed based upon the amount of the purchase or specific products purchased. If you have questions, contact your dealer.

Scenario #1

State tax is always charged at 6%. County tax of 1% is charged only on the first $5000. If the invoice exceeds $5000 then the state still gets 6% but the County stops at a maximum tax of $50 (1% of $5000). These taxes apply to every product sold.

TIP: use Tax Description 1 for State Tax and and Tax Description 2 for County Tax so that you can better pinpoint taxes being charged.

Note that the County Tax is listed first in this final setup.

Details of State 6% tax rate

Details of County 1% tax rate

Sample Sale Using the above settings, a sample invoice shows that a sale of $6000.00 in product is assessed the 6% for the state ($360.00) yet only $50.00 for the county which is 1% on the first $5000.00 and no tax for any amount thereafter.

Sales Tax Report - Printing a detailed Sales Tax Report will show how both the County and State taxes were handled.

Scenario #2

Only when a motorcycle sells for more than $3000.00 is the county tax waived for any amount above $3000. State tax stays in effect. All other products are charged normally except when sold with a motorcycle.

In this scenario the normal state and county taxes are in effect except when a motorcycle is sold. This requires the creation of a tax category for motorcycles and setup rules to operate when the motorcycle tax category is involved.

| • | You need to create... |

a Tax Category specifically for Motorcycles - Choose the Add button for Tax Categories. You will then need to edit your inventory categories (Maintenance: Categories) and for any category which contains motorcycles, assign the Motorcycles tax category instead of the Merchandise tax category.

3 County Tax Rates in the All Tax Rates section of Tax Setup

(suggestion) use Tax Description 1 for State Tax and and Tax Description 2 for County Tax

| • | Assign tax rates to each tax category |

First, the easy Tax Rates were probably defined automatically when you created your company and you were asked for tax rates.

The State Tax Rate

The Exempt Tax Rate

Now for the Special County Taxes

When you create the 3 County Tax Rates you need to set specific actions and limits as pictured below.

TIP: For training purposes the tax rate description helps to identify the purpose of the tax rate.

County > 3000 means the rate if the motorcycle sells for more than $3000.00

County < 3000 means the rate if the motorcycle sells for less than $3000.00

County means the rate for all other inventory items not related to motorcycles.

Define the Tax rate for motorcycles sold for more than $3000. Note the entry in the "Tax Rate Exceptions" section.

Define the Tax rate for motorcycles sold for less than $3000. Note the entry in the "Tax Rate Exceptions" section.

Here you will be setting the normal County Tax for all inventory other than motorcycles. Again, note the entry in the "Tax Rates Exceptions" section.

Assign Tax Rates

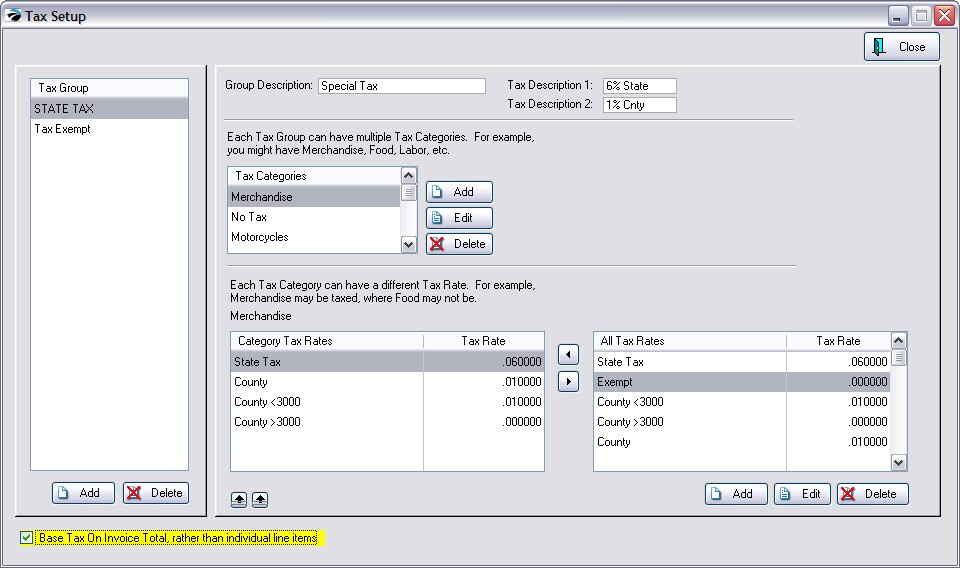

Not only do all three tax rates need to be assigned to the tax category, the sequence of tax rates is important. Use the "transfer" buttons between the Category Tax Rates and the All Tax Rates. Use the "reposition" buttons below Category Tax Rates to move the highlighted rate up or down.

Tax Group STATE TAX

Merchandise Tax Category

1st State

2nd County

3rd County < 3000

4th County > 3000

No Tax Tax Category

Exempt

Motorcycles Tax Category

State

County

County < 3000

County > 3000

Tax Group TAX EXEMPT - each tax category is set to exempt, even the motorcycle tax category

Merchandise Tax Category

Exempt

No Tax Tax Category

Exempt

Motorcycles Tax Category

Exempt

Results When Selling

If the motorcycle sells for $2000 then the county tax will be $20.00 or 1%

If the motorcycle sells for $4500 then the county tax is not $45.00 but just $30.00 because only the first 3000.00 is taxed at 1%.

Scenario #3

When a motorcycle sells for more than $3000.00 then county tax is waived for any amount above $3000 INCLUDING taxation of all other items on the invoice, even if they are not motorcycles. However, to qualify for this exemption a motorcycle must appear on the invoice.

Same as described in Scenario #2. Plus, in the lower left corner of the Tax Setup screen is an option which should ONLY be used for this scenario. Activate the option with a checkmark.

Taxation of individual line items will be ignored. Instead the grand total of the invoice will be used to calculate the tax.