Accounts Receivable is a deferred payment option. Rather than requiring payment at the time of invoicing, you can choose to bill the customer later by placing the charges on a Store Account. At a future time, usually within a month, payment will be due including applicable finance charges.

You may print AR Statements and mail them to your customer. The statement form is of two types: Balance Forward and Transaction Forward. As part of Accounts Receivable, you may utilize Finance Company or Third Party Billing wherein the customer makes a purchase, but another organization becomes responsible for paying the bill.

When you receive payments from customers in person or in the mail, you can selectively choose which invoices to pay off or apply payment towards the oldest invoices first.

In addition, POSitive allows your customers to earn AR Credits through the Frequent Buyer program; make payments towards AR Credits in advance of making any purchases; post refunds for returned products towards AR Credits; and utilize all or portions of accumulated store credits when making general purchases.

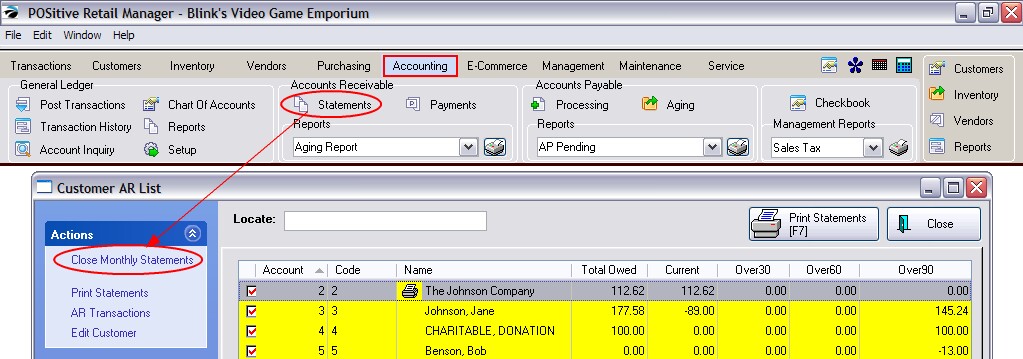

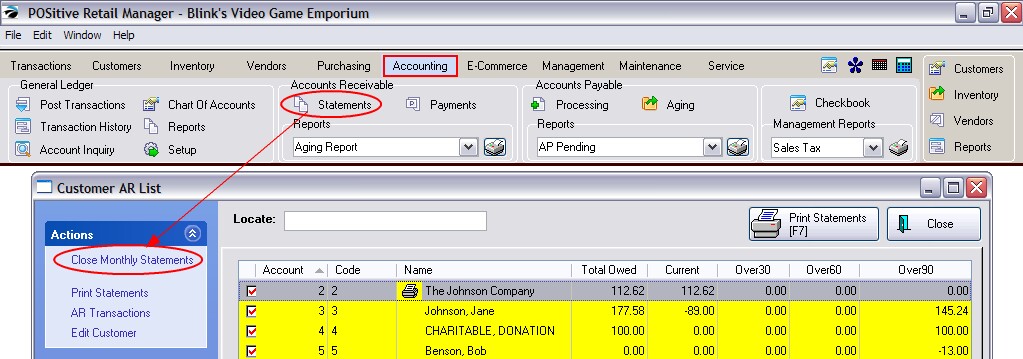

| • | Important Monthly Activity - Close AR Statements each month. Even if you do not use all of the features of Accounts Receivable nor plan to print AR Statements, it is important to close the statements at least once per month. This assures that relative databases are updated properly. See Customer AR List) |

THINGS TO DO

| • | Review the function and capabilities of the Accounts Receivable feature. |

THINGS TO UNDERSTAND

Accounts Receivable Is Not Affected By...

Your ability to take deposits on layaways and orders, sell and redeem gift certificates, accept checks and credit cards in payment, utilize coupons, and utilize discounting at the invoice level.

Accounts Receivable in POSitive lets you

| • | put your customers on store account in advance or at the time of invoicing |

| • | establish balance forward charges if you are converting from a previous sales system |

| • | issue refunds which can only be used towards future purchases |

| • | generate Store Credit reports |

| • | generate AR aging reports |

| • | print AR statements: Balance Forward or Transaction Based |

| • | charge monthly finance charges |

| • | set customer credit limits |

| • | define customer global discounts |

| • | accept advance payment for services or goods before an invoice is created |

| • | reward your repeat customers with store credit |

| • | utilize third party or finance company billing as an alternative to store account |

| • | control employee access to AR features |

Common Activities

| • | How To Add and Edit Off-Setting AR Transactions (see AR History) |

| • | How To Review A Customer's AR History (see AR History) |

Common Mistakes

| • | Cannot Select "Store Account" as a Tender Type - When tendering an invoice for a customer, the option to tender on Store Account will only be visible if the customer selected has a valid address. It is assumed that an AR Statement will be printed and hence a valid mailing address is required. Solution: edit the customer record and enter something in the Address 1 line. |

| • | Wrong Tender Type - When tendering an invoice, the wrong tender type may have been selected This problem is easily discovered if the cash drawer is balanced daily. Solution: do not continue with balancing the drawer. Go to Invoice History, void the invoice, and create a new invoice from the old and then accept the proper tender type. (Other solutions might be available depending upon needs. Contact your dealer or POSitive Software Support.) |