| Show/Hide Hidden Text |

The following is one procedure for handling cash transfers between multiple banks/checking accounts.

SETUP

| • | You will need to create multiple checkbook registers. (see Multiple Banks/Checkbooks) |

| • | You will need to add a Liability GL Account for tracking the transfer of monies. (e.g. 22005-001 Funds Clearing Account (Liability)) sample |

|

| • | Consider adding a Vendor named "Transfer To Bank X" to make check writing easier (see Step 2) |

PROCESS

Step 1

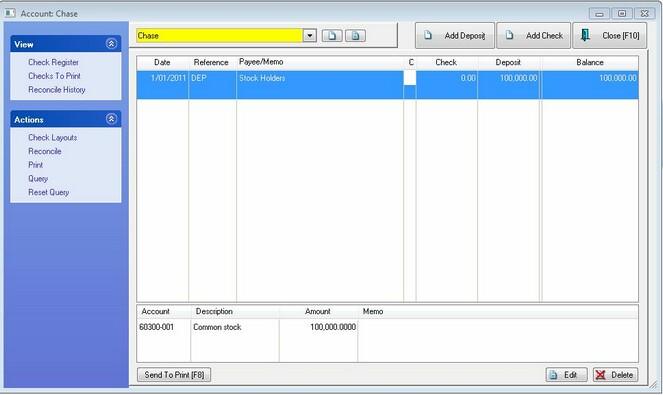

Open the checkbook which contains cash funds to be transferred.

Step 2

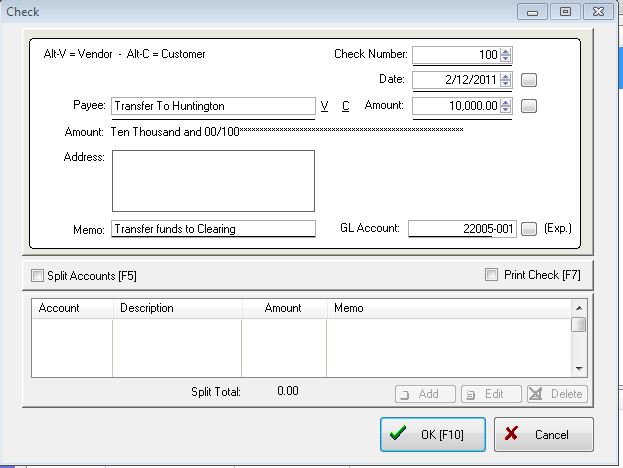

Choose Add Check (Payee would be a special vendor used specifically for cash transfers only)

Fill in check number, date, amount, and add a memo if desired, but be sure to assign the 22005-001 Funds Clearing Account (Liability)

Leave the Print Check switch unchecked.

Step 3

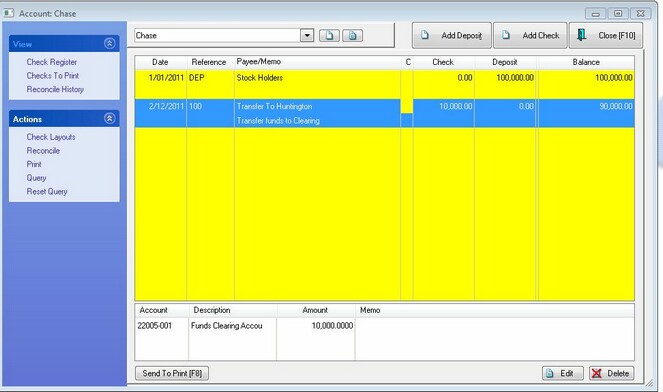

The above entry is now deducting from the balance of this bank account.

Step 4

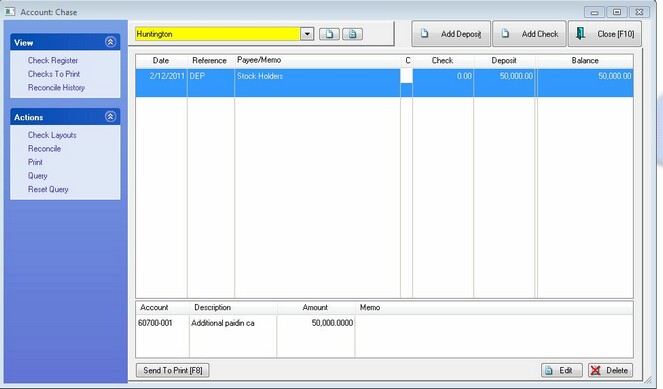

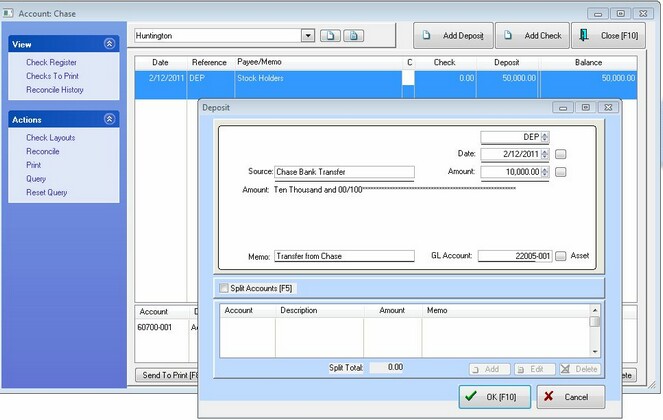

Open the checkbook which will receive cash funds to be transferred.

Step 5

Choose the Add Deposit button and fill in the detail.

Fill in the Date, Source "Name of Bank Transfer," and the amount being received. Use the Memo field if desired, but be sure to assign the 22005-001 Funds Clearing Account (Liability). Choose OK [F10].

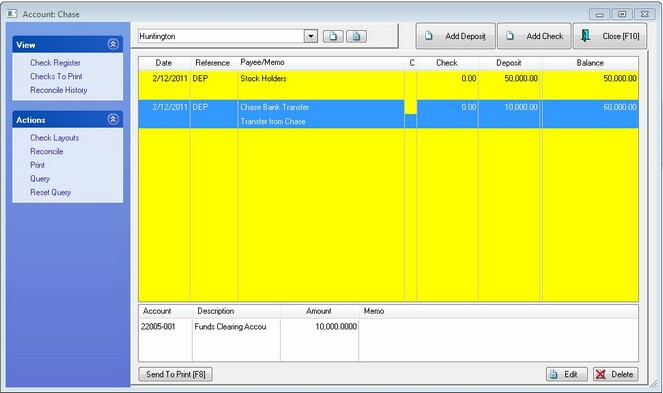

Step 6

The transferred deposit is now increasing the balance of this checkbook.

Step 7

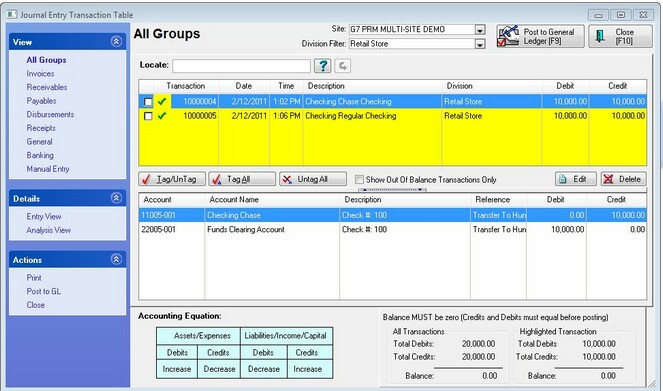

The above steps will have automatically added Journal Entries to the Accounting: Post Transactions screen.

Here is the "Check" entry transferring the funds to the 22005-001 Funds Clearing Account (Liability)

Step 8

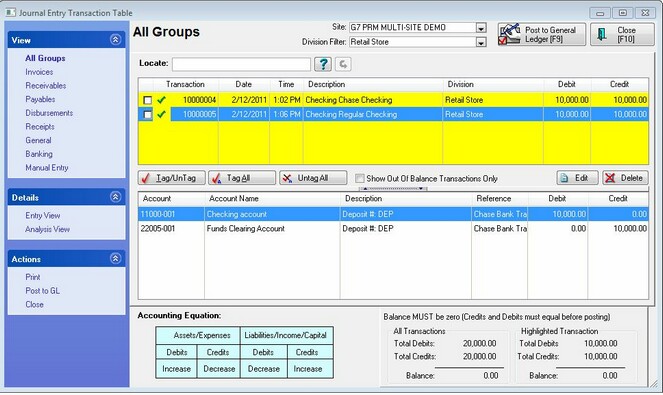

Here is the "Deposit" entry receiving the funds from the 22005-001 Funds Clearing Account (Liability)

Step 9

As part of your normal GL Journal processes, tag these entries and Post To General Ledger [F9]