The Sales Tax Report (see Report Center) compiles all invoices for the date range.

Grand Totals

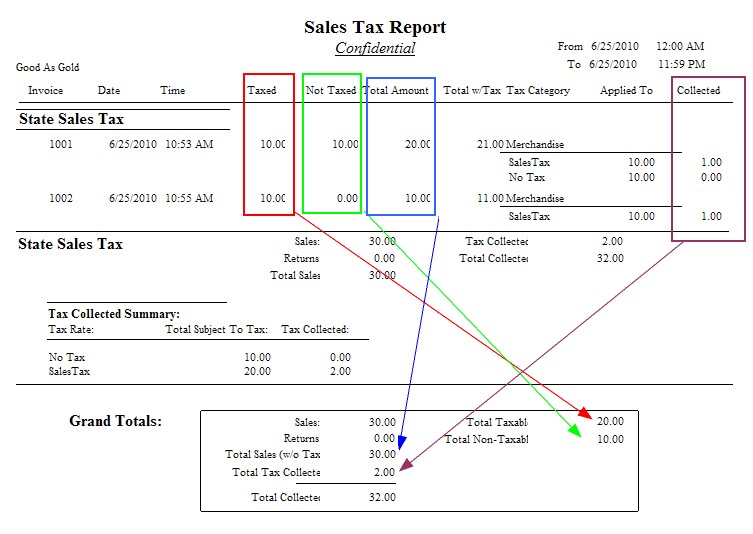

The Grand Totals summary on the last page of the report are drawn from specific areas of the full detail report.

Taxed - inventory items assigned to a category which charges tax will be reported in the "Taxed" column.

Not Taxed - inventory items assigned to a category which never charges tax will be reported in the "Not Taxed" column.

Total Amount - a sum of Taxed and Not Taxed items per invoice.

Tax Collected - the total taxes charged per invoice with a breakdown of multiple taxes involved.

Tax Collected Summary

The Sales Tax Report (see Report Center) breaks information down into Tax Groups as defined under Maintenance: Tax Rates.

Each invoice will break out all of the taxes involved.

The Tax Collected Summary is for the invoices of a "Tax Group".

At the end of the detailed listing is a summation for the tax group.

Grand Totals for the reporting period are summarized combining all sales and taxes for all Tax Groups.

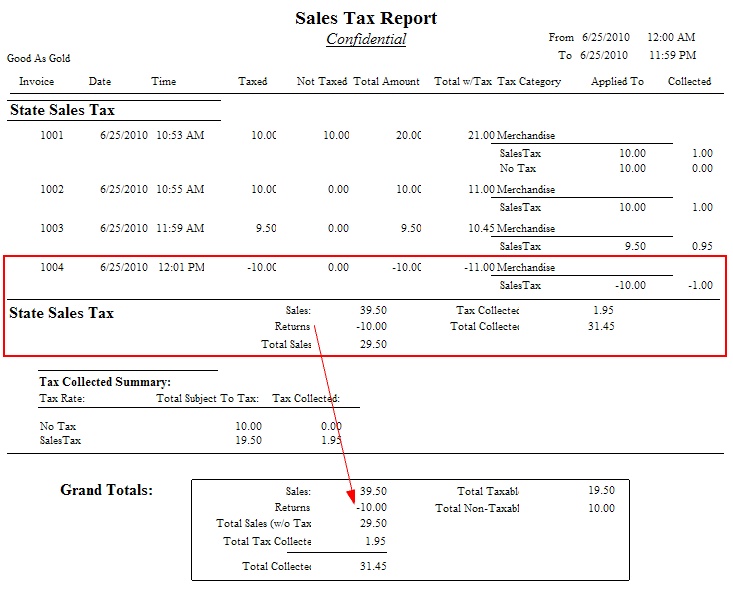

Returns

Returns on Invoices will refund applicable sales taxes collected. Total Sales will be reduced and Grand Totals will be updated.