Tax Override

This is an optional setting and is only used in special cases. An inventory item is always taxed based upon the category to which it is assigned. However, in special circumstances, a different tax category can be assigned to this inventory item only.

Scenario

In the UK, for example, clothing for children is taxed differently than clothing for adults. This tax rate at which they are sold can vary from zero tax to the Standard tax rate. Normally, a matrix which contains all sizes of a particular style of clothing will automatically apply the tax rate of the category to which the matrix header is assigned. That means that all sizes of clothing will be charged the same tax rate.

SETUP

In Advance: create Tax Category(s) as needed. (Maintenance: Tax Rates)

The Tax Override option is available on a per inventory item basis, however it is only activated manually per item based upon the specific needs of the item. In the scenario above, the items in children's sizes require a tax override.

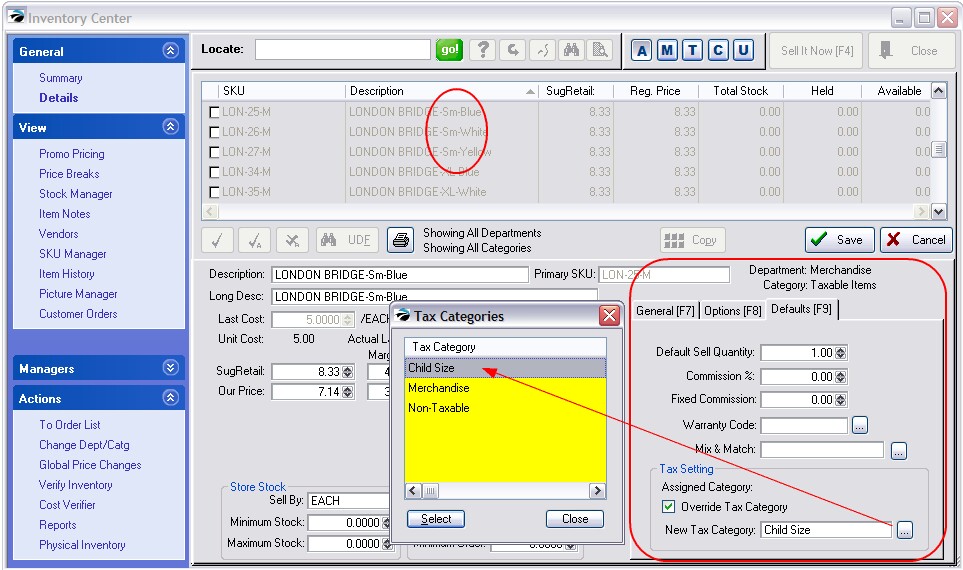

1) Edit the inventory item

2) Open the Defaults tab [F9]

3) Activate Override Tax Category

4) Select an appropriate Tax Category for the item by clicking on the Lookup button

Another Application

In Canada, all food products are non-taxable with the exception of foods considered less nutritional which will be taxed. One would normally create a Food (nontaxable) category and a Food (taxable) category to keep these food products separated and taxed properly. However, all Foods can be in the same category and use this New Tax Category setting only on the less nutritional items. Tax categories could be called HST5, HST8, HST13, etc.