LINE ITEM

While invoicing, you can change the tax charged on a particular line item.

This has special applications

| • | The line item is tax exempt because it will be resold |

| • | The line item is not subject to the full tax rate, but only one tax rate (for example, GST or PST). |

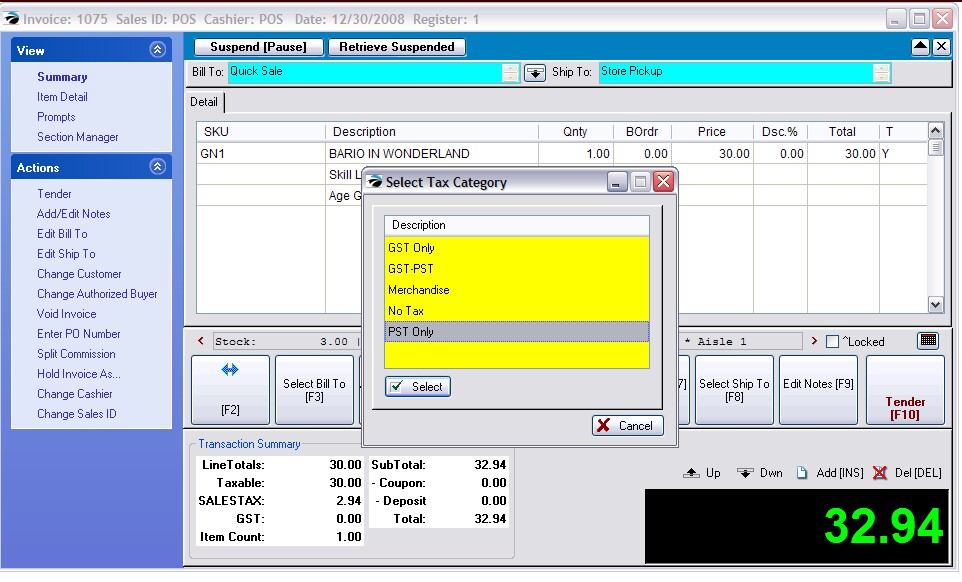

1) Highlight the line item which needs tax modification.

2) Press CTRL-X

3) A "Select Tax Category" window will be displayed. Select an appropriate tax rate to be applied to the line item.

SUBSEQUENT ITEMS

SUBSEQUENT ITEMS

While invoicing, you can change the tax charged on a series of line items.

This has special applications

| • | The following line items are all tax exempt because it will be resold |

| • | The following line items are not subject to the full tax rate, but only one tax rate (for example, GST or PST). |

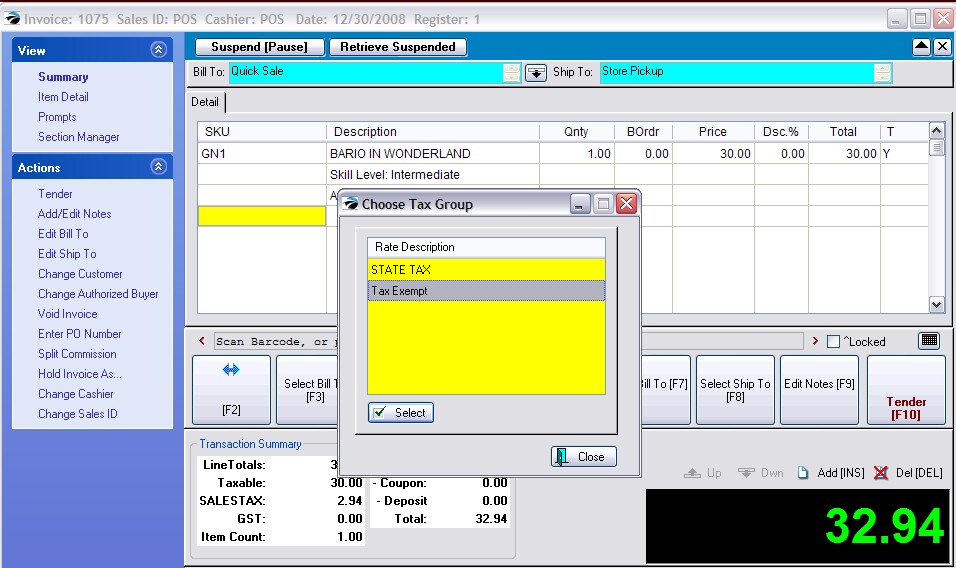

1) Highlight the breaking point line item which needs tax modification.

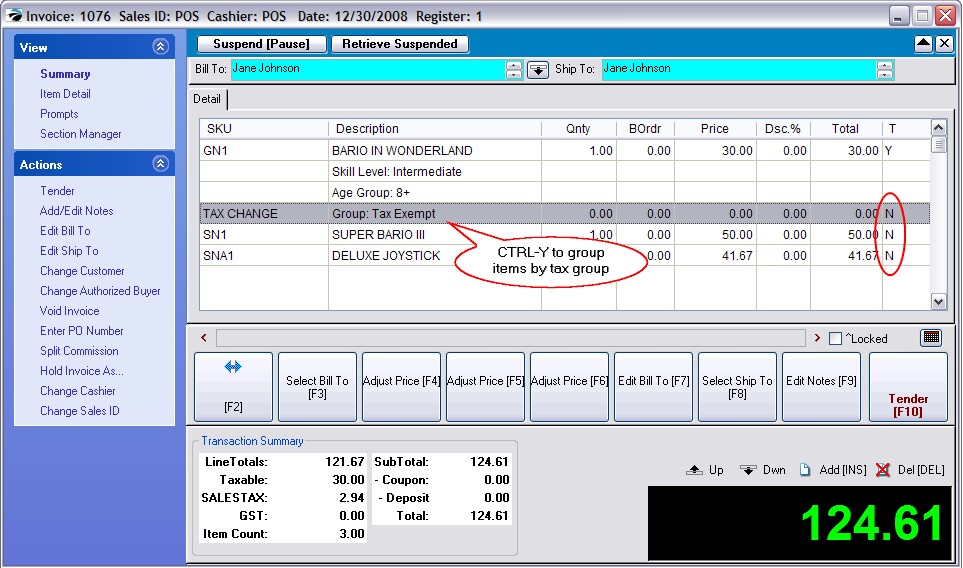

2) Press CTRL-Y

3) A "Select Tax Group" window will be displayed. Select an appropriate tax rate to be applied to the subsequent line items.

Here is an example of the Tax Exempt Line entry. Items below the line will not charge tax, whereas items above the line do charge tax.

Note: use CTRL-up or down arrow to move line items across this separating entry.