Tax information and settings are not uploaded to your Magento website. Therefore, setting up taxes in Magento is a manual process, but it’s similar to the tax configuration used in your POSitive software product.

Steps in the Magento Tax Setup Process:

| 1) | Setup Customer Tax Classes (Sales > Tax > Customer Tax Classes) |

| o | Similar to adding a Tax Group (e.g. ‘State Sales Tax’ & ‘Tax Exempt’) in your POSitive software product |

| o | Remember to manage your Magento Customer Groups and assign them to your Customer Tax Classes. |

| 2) | Setup Product Tax Classes (Sales > Tax > Product Tax Classes) |

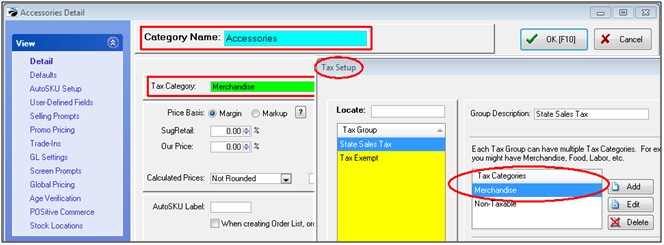

| o | Similar to adding Tax Categories (e.g. ‘Merchandise’ & ‘Non-Taxable’) in your POSitive software product and must match the Tax Category selected for each inventory category (see image sample below) |

| o | See ‘Basic Magento Taxes Setup (US)’ addendum below as an example and a reference. |

| 3) | Setup Tax Rules (Sales > Tax > Manage Tax Rules) |

| o | Similar to adding Tax Rates (e.g. Sales Tax & No Tax) in your POSitive software product |

| 4) | Setup Tax Zones & Rates (Sales > Tax > Manage Tax Zones & Rates) |

| o | Similar to configuring your Tax Group in your POSitive software product |

For detailed instructions on how to set up general tax calculations, see Understanding How to Set Up Taxes in Magento CE 1.8 and EE 1.13 (Four-Part Series).

http://www.magentocommerce.com/knowledge-base/entry/ce18-and-ee113-setup-taxes

|