| Show/Hide Hidden Text |

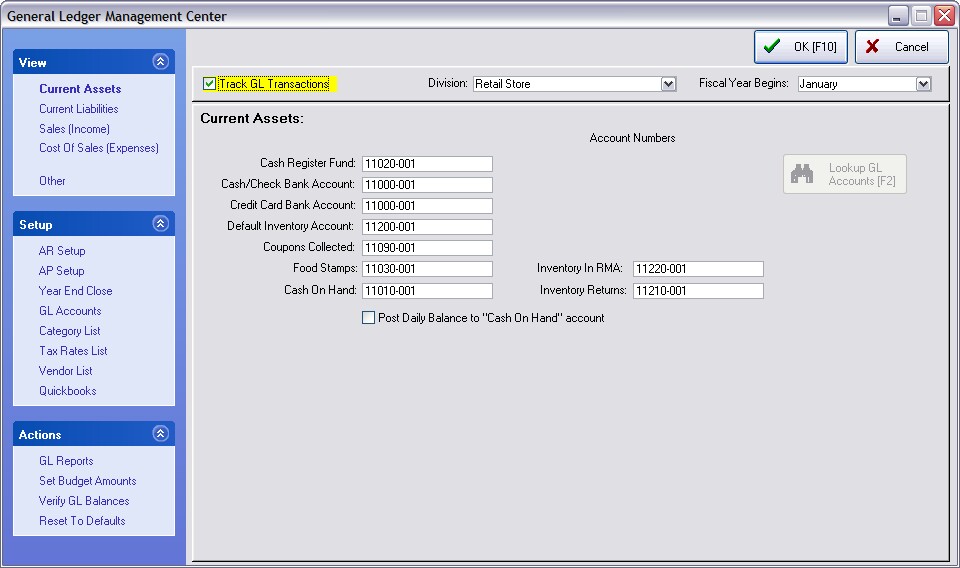

The GL Management Center is an interface to define which chart of accounts code will be used with each POSitive element. Before attempting to complete this interface, you should have a chart of accounts already defined.

You may use the existing chart of accounts, but if any changes are to be made, make them first.

Complete each of the following sections.

Current Assets

Current Liabilities

Sales (Income)

Cost Of Sales (Expenses)

Other

AR Setup

AP Setup

Year End Close

1) Turn ON "Track GL Transactions."

2) Select a Division (optional) - This optional setting allows the company to monitor sales based upon internal accounting organizations (Divisions) within the company: Retail, Wholesale, Internet Sales, Service, etc. (see Company Setup) The same account number is used with each division, however the suffix numbers -001, -002, -003, etc distinguish the division assignment. These accounts with suffixes are automatically generated when a new division is created.

3) Check the Fiscal Year Begins box to make sure it is correct. By default POSitive begins a fiscal year in January. You may change the Fiscal Start Month.

4) Fill in each accounting subject with one of your GL account numbers. You may press the Lookup GL button at the bottom right to view and select from your chart of accounts. If the required account is not in the list, then you may add it.

FOR EXAMPLE,

-- Current Assets --

___ Fill in with appropriate GL Account numbers

Cash Register Fund 11020-001

Cash/Check Bank Account 11000-001

Credit Card Bank Account 11000-001

Default Inventory Account 11200-001

Coupons Collected 11090-001

Food Stamps 11030-001

Cash On Hand 11010-001

Inventory In RMA 11220-001

Inventory Returns 11210-001

Cash Register Fund and Cash On Hand should be different accounts. Cash Register fund is what is in your cash drawer at any given time, and Cash On Hand is the total from after you've balanced the register, waiting for you to deposit it (sitting in the safe).

Basically, when posting tender it goes from Cash Register Fund to Cash On Hand, then when you do your deposit in the checkbook, that goes from Cash On Hand to the Checking Account.

___ Post Daily Balance to "Cash On Hand" account* - If you only have one checking account, you may wish to leave this unchecked. If you have more than one checking account rather than posting directly to the Cash/Check Bank Account, this account is a suspense account used when all cash drawers are balanced and the monies not yet deposited at the bank.

| • | If checked - when balancing the cash drawer(s), the amount for deposit will be assigned to the Cash On Hand GL Account 11010-001. This account number will be used when manually making a deposit to the checkbook. |

| • | If unchecked - when balancing the cash drawer(s), the amount for deposit will be assigned to the Cash/Check Bank Account 11000-100. You still need to manually make a deposit in the checkbook, but as you do, it is suggested that you select the same account 11000-100 for both the debit and credit values. |

The checkbook feature of POSitive does not "automatically" enter your cash register deposit for the day. The checkbook requires a manual entry of a deposit. When you make a deposit you select the Cash On Hand Account or Cash/Check Bank Account as the source based upon your setting of the above option. |

* Leave this option unchecked if you are assigning GL Accounts to your Tender Types (for example Visa Card uses GL Account 11001-001) otherwise the GL Account 11001-001 will not be utilized in GL Journal.

-- Current Liabilites --

Customer Deposits 22040-001

Customer Refunds/Store Credits 22050-001

Gift Certificates 22060-001

Sales Tax Payable 22190-001

Purchases Clearing 22200-001 - for receiving items on purchase orders - automatically removed when post AP payment

-- Sales (Income) --

Default Sales Income 33020-001

Sales Returns/Allowances 33050-001

Sales Discounts 33060-001

-- Cost Of Sales (Expenses) --

From Purchase Orders 44310-001

Tax On Purchase Orders 44320-001

Freight 44330-001

Tax On Freight 44340-001

Purchase Discounts 44410-001

Inventory Discards 44350-001

___ Treat Landed Cost as Actual Cost

By way of explanation, POSitive tracks both the Actual Cost (as defined by the vendor) and the Landed Cost which is the Actual Cost plus a portion of the shipping charges. By default, General Ledger only looks at the Actual Cost field, but with this switch you can force GL to use the Landed Cost field for a more accurate profit report.

| • | If checked, for general ledger purposes, the landed cost of inventory will be used as if it were an Actual Cost. |

| • | If unchecked, only the vendor cost will be reported to General Ledger. |

-- Other --

Store Payouts (Expense) 44550-001

Uncollectable AR (Expense) 44560-001

Cash Over/Under (Expense) 44520-001

AR Discounts Applied (Expense) 44280-001

AP Discounts Taken (Income) 33060-001

Default Deposit Source (Asset) 11010-001

Current Year Proft/Loss(Capital) 60050-001

Inventory Adjustments (Capital) 60200-001

SETUP of GL Processes

-- AR Setup --

Default Accounts Receivable (Asset Account) 11100-001

Finance Charges (Asset Account) 11070-001

Unapplied AR Credits (Liability Account) 22840-001

Discounts (Expense Account) 44300-001

When adding an AR Charge transaction manually, you need to Debit an

AR Account and Credit a Capital Account

Debit Accounts Receivable (Increase Asset Account) 11100-001

Credit Account (Increase Account) 51111-001 (TIP: Create a Suspense Account for this field and review it weekly to make reassignments as needed. This is sometimes used for manually giving the customer a store credit)

-- AP Setup --

Default Accounts Payable (Liability Account) 22000-001

Unapplied AP Credits (Asset Account) 11840-001

When adding an AP transaction manually, you need to Debit an Expense

Account if you are adding an Invoice or Credit an Income Account

if you are adding a Credit Memo.

Invoice Expense Account (Expense Account) 44310-001

Credit Memo Income Account (Income Account) 33230-001

Note: Can you turn off the AP-Part in GL if you choose not to use it? In POSitive, if you leave the AP accounts blank in the GL Setup then it won't post anything to it.

-- Year End Close --

At year end all income and expense accounts will

be closed to an equity (capital) account.

Retained Earnings (Capital Account) 60100-001

-- GL Accounts --

A listing of all GL Accounts as currently defined

-- Category List -- 000000 ALL BLANK

Normally blank, however you can assign some special account numbers to select categories

-- Tax Rates List -- 000000 ALL BLANK

Normally blank because Sales Tax Payable is already set above.

(Only needs to be filled in if you have a specific account for it to go into.)

-- Vendor List -- 000000 ALL BLANK

Normally blank, however you can assign some special account numbers to select vendors such as Store Use, Damaged Goods

-- Quickbooks -- (Optional)

This is a Direct interface with Quickbooks with only those functions listed on the screen.