If your store is in a locale where you tender purchases in various foreign currencies, POSitive will allow you to setup current exchange rates, then tender foreign monies in payment and return local currency in change.

This option is only used for handling foreign cash.

This topic describes what managers need to do to setup foreign currency rates and how sales clerks tender foreign money.

MANAGERS: Advance Setup

1) Define Exchange Rates

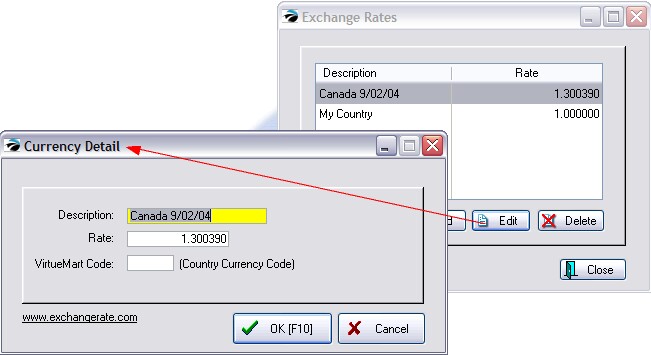

Go to Maintenance: Definitions: Exchange Rates.

Choose ADD

Enter a description of the currency and include the date so you will know when the rate was last changed.

TIP: Click on the link www.exchangerate.com and get the current exchange rate.

Note: the My Country rate is always 1.00000. The Foreign currency rate is what your dollar is worth in that foreign currency.

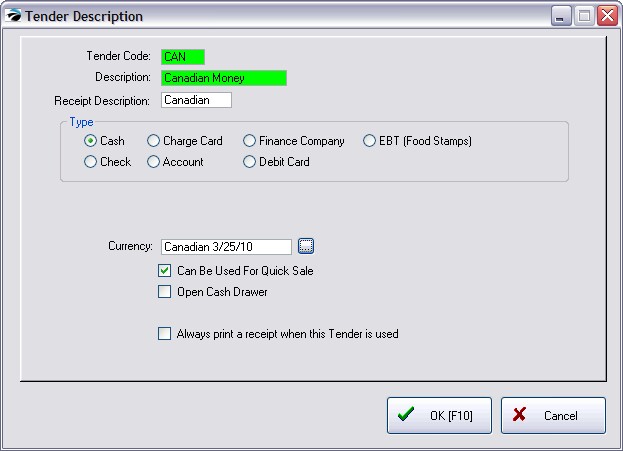

2) Define a new Tender Definition for each currency

Go to Maintenance: Definitions: Tender. (see Tender Definitions)

Choose Add

Enter field values as in this example..

SALES CLERK: Processing Invoices

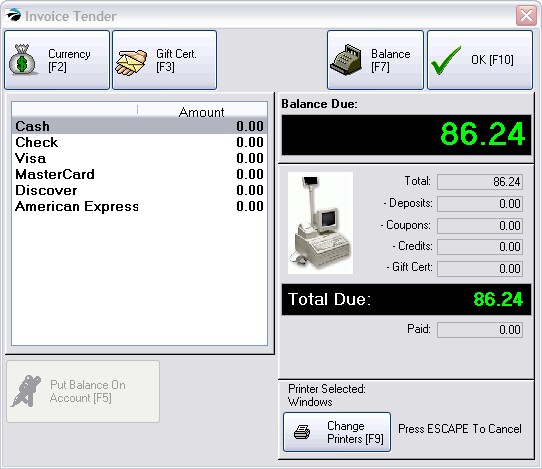

When you complete an invoice and open the Invoice Tender screen, you will have the ability to switch currencies. Note that the Foreign Currency (Canadian Cash) is not immediately visible. (see Invoice Tender)

Press Currency [F2]

A list of Exchange Rates will be displayed.

Select the Foreign Currency desired.

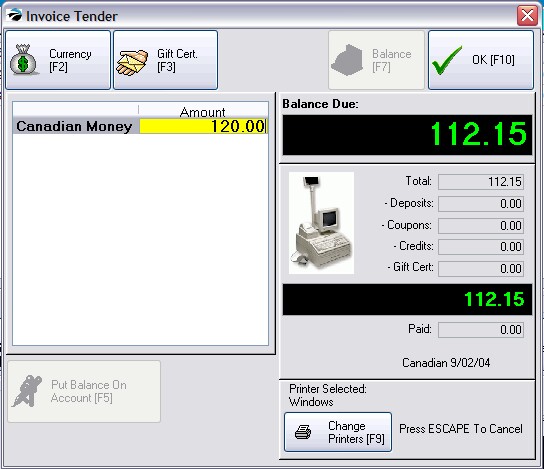

The Invoice Tender screen will now change the Balance Due field to reflect the value in foreign currency.

On the left, enter the value of foreign currency being tendered.

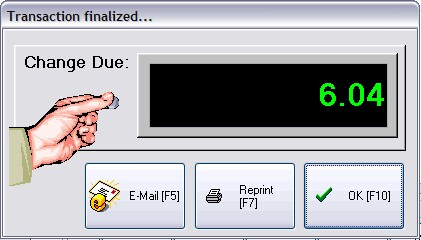

The change due will be calculated in your local currency. You will not be making change in the foreign currency.

Printouts

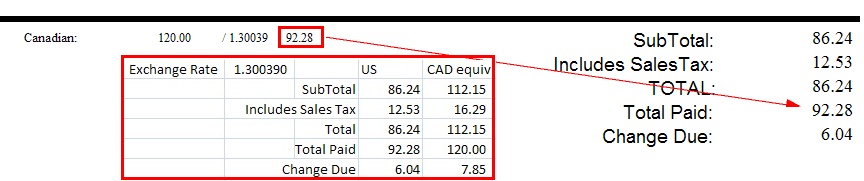

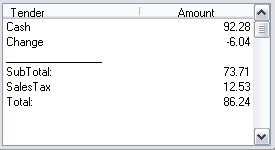

Note: Your invoice printouts may not readily reflect the use of foreign money, but if you look closely it makes sense. ALL totals at the far right are expressed in "My Country" currency.

In the following example, the purchase with tax was US $86.24 or $112.15 Canadian with tax. Tender received was 120.00 in Canadian money and the change of 7.85 in Canadian was converted to US $6.04. POSitive ALWAYS refunds in "My Country" currency, not in foreign currency.

Note: The 92.28 often causes confusion. It is the calculated US equivalent of the Canadian 120.00. This issue is also evident in Invoice History which will also reflect the amount paid in the US equivalent.

Changes In Balance Cash Drawer

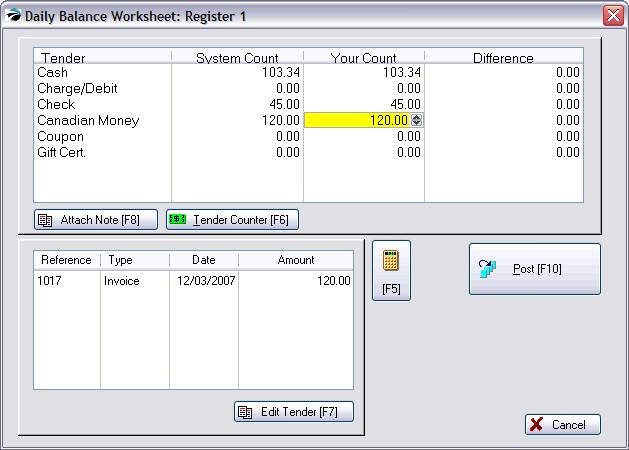

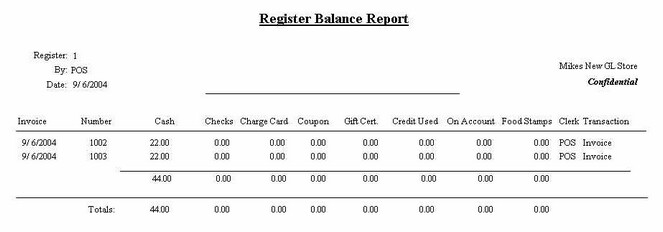

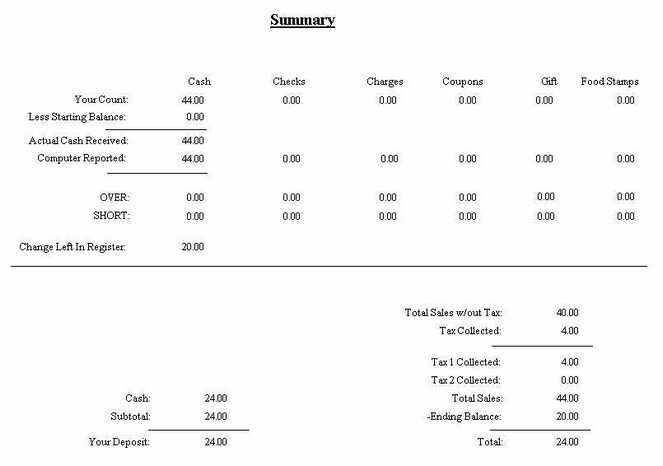

At the end of the day when you balance the cash drawer you will see a few changes.

1) the Cash field will reflect how much was paid out in the equivalent of your currency. (For example, 1.07 was deducted.)

2) the foreign currency is listed separately. You should be able to find it in the cash drawer and account for it.

The End of Day report will not reflect foreign currency values, but will only show your currency values on all invoices.

GENERAL LEDGER

When making your deposits, you will need to exchange the foreign currency with the bank. Because exchange rates vary on a daily basis, you may not be given the exact calculated equivalent.

| • | You will need to manually make an adjustment to General Ledger. |

After balancing the register, the foreign currency transactions are also reported to General Ledger's Journal Entry Transaction Table, without any further reference to the foreign currency. See Journal Entry Transaction Table.