POSitive will support the use of Food Stamps as payment towards qualifying products. On the customer invoice you add all items being purchased. At the tendering screen, all items on the invoice which qualify for food stamps are totaled and you apply payment with food stamps first. Then the remaining balance is paid by cash, check, or credit card.

MANAGERS: Advance Setup

Before the tracking of food stamps will work, you need to

| • | activate "Enable Food Stamp Tracking" (File: System Setup: Inventory: General tab: bottom of the list) |

| • | activate "EBT Processor" (electronic benefits transactions) with PCCharge. (Management: Credit Cards: Setup: EBT) |

| • | create a Food Stamp tender type (Management: Definitions: Tender) It is recommended that the tender type be moved to the top of the list because tendering food stamps should be done before any other tender is selected. |

| • | select a Food Stamp GL Account in General Ledger Management Center (Accounting: General Ledger: GL Setup: Current Assets) |

| • | set inventory category(s) default to "Allow Food Stamps" (Maintenance: Categories: highlight a food category and choose Defaults [F5] and activate the switch ) |

| • | create inventory items to be assigned to the food stamp category(s). (Note: on the Options [F8] the Allow Food Stamps option will be automatically active.) |

SALES CLERKS: Handling Invoices With Food Stamps

1) Create an invoice as you normally would. It may include a mix of items which do and do not qualify for food stamps. Such items can be added to the invoice in any sequence.

For example, Yogurt qualifies for food stamps whereas Bario In Wonderland does not.

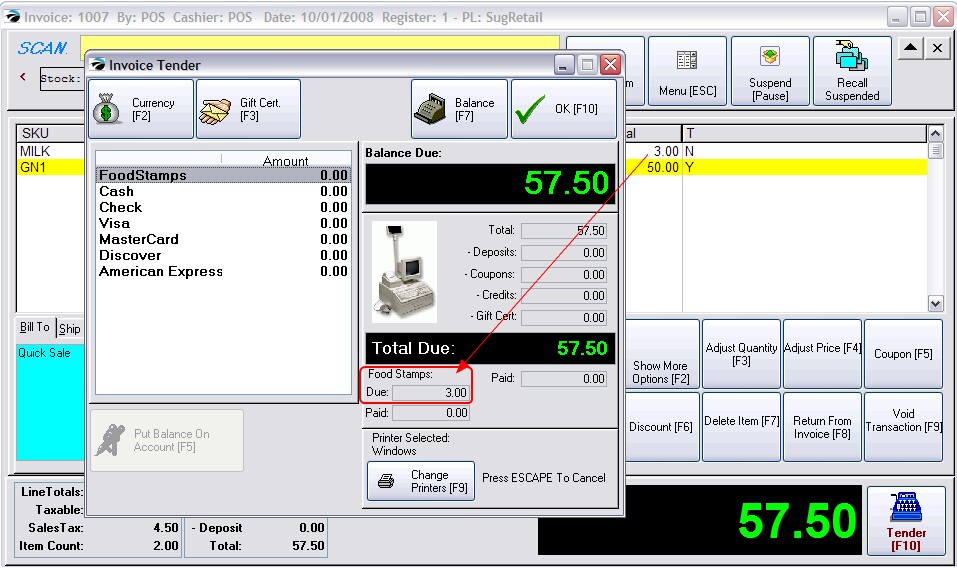

2) Press F10 to tender the invoice.

(It is suggested that Food Stamps tender type be at the top of the list because they need to be tendered first. See (Tender Definitions))

Note that in the lower right corner the value of the qualifying food stamp items is totaled.

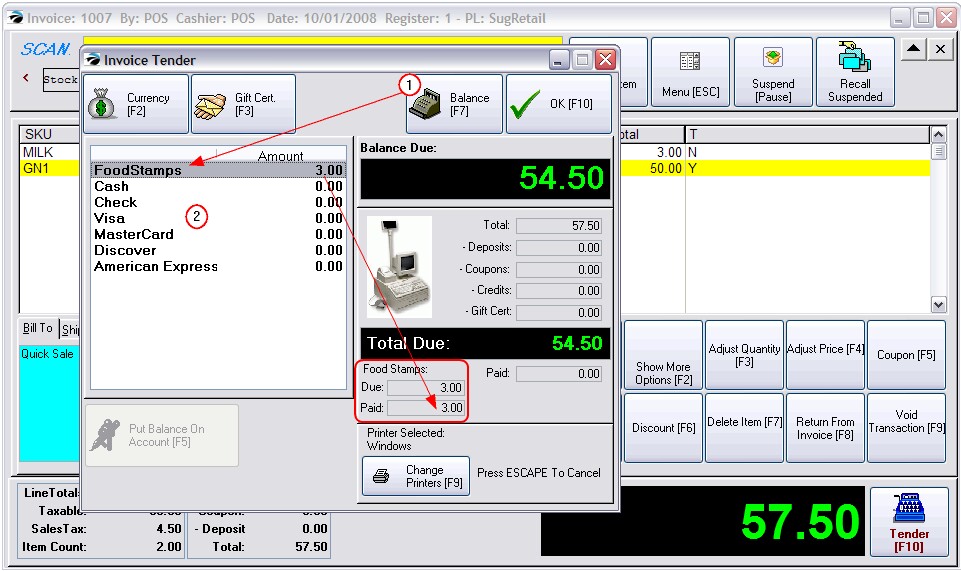

3) Press Enter (or use Balance [F7] on the Food Stamps line and the correct value is automatically filled in.

In this example, the original charge is $57.50. Deducting 3.00 in food stamps, leaves a balance of just 54.40 which may be paid for by cash, check, or credit card.

4) Continue to process the invoice as you normally would.

Food Stamps On Reports

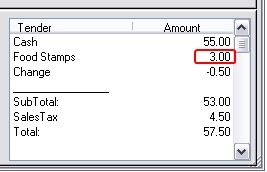

| • | The lower right corner of Invoice History will show that payment was made in part by Food Stamps. |

| • | Balancing the cash drawer will include an EBT (a Food Stamps) field and the End Of Day Reports also include Food Stamp totals. |

| • | The Tender History report includes the option to select Food Stamps. |

| • | General Ledger will be updated properly. |