If you need to add different tax rates for many jurisdictions, it may save time to import a file that contains the applicable retail tax rates. Zip2Tax can provide businesses with retail sales tax rates for all jurisdictions in the U.S. and Canada based on zipcode (or postal code). For more information and pricing visit Zip2Tax.com.

You may purchase retail tax tables by state, or for the entire U.S. or Canada. Zip2Tax will furnish a CSV file which can be imported into POSitive. You may also edit this file in Excel to remove jurisdictions you don't need. If you do this, be sure to save the edited file as CSV and not an Excel file. Also, you may import new files as often as necessary to update retail tax rates.

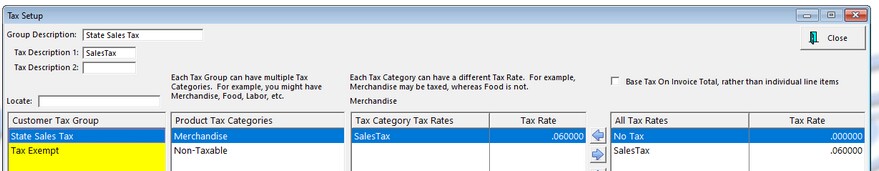

Your current Tax Rates may look like this (Maintenance, Tax Rates):

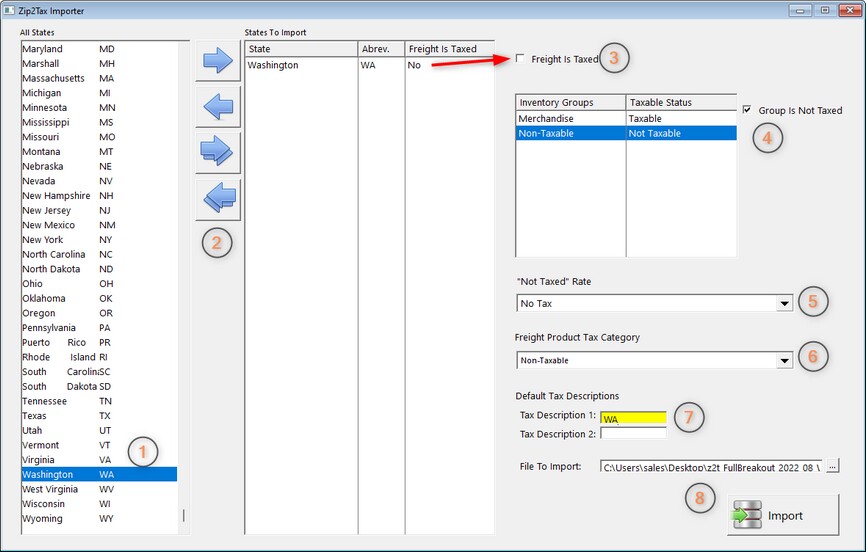

To import a Zip2Tax file go to Maintenance, Data Utilities, Utilities, Zip2Tax Import. In our example we're importing a retail sales tax table for Washington state:

1. Highlight the state you are importing tax rates for.

2. Use the Single Arrow pointing right to move the state to the States to Import list. Use the Single Arrow pointing left to remove a state. The Double Arrows add or remove all states on the list.

3. In our example Freight is not taxed, so make sure Freight is Taxed is unchecked.

4. Highlight your Non-Taxable Inventory Group and check Group is Not Taxed.

5. "Not Taxed" Rate should be set to No Tax.

6. Freight Product Tax Category should be set to Non-Taxable.

7. Enter the Default Tax Descriptions. In our example we are only using one labeled WA.

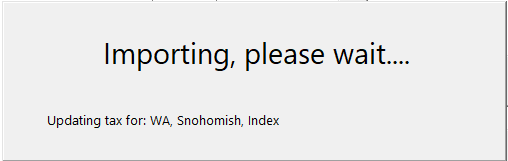

8. Finally, click on the box with three dots to open a browse windows and locate and select your Zip2Tax import file. Click the import button to start the process, which take a minute or more, depending on the number of jurisdictions.

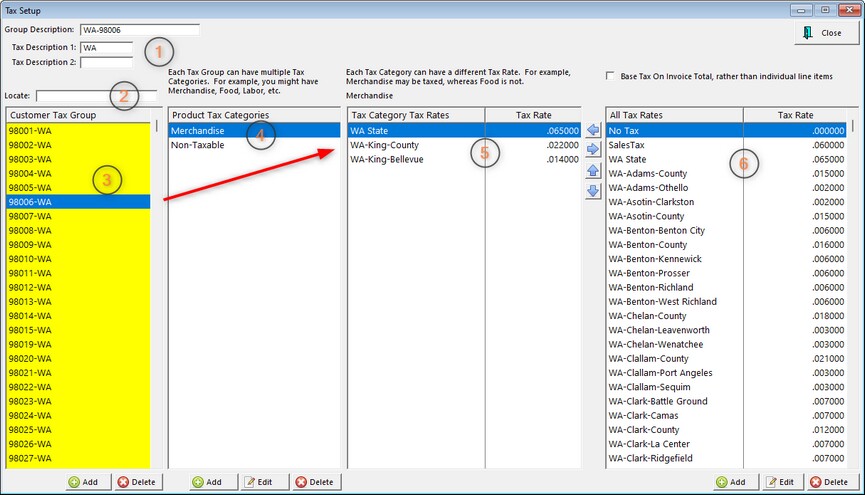

Once the import has completed return to Maintenance, Tax Rates:

1. This shows your the Group Description and Tax Description for the group highlighted below.

2 - 3. Zip2Tax uses zipcodes to organize the imported Customer Tax Groups, and you can use the search box to highlight a specific zipcode. Also, any Customer Tax Groups that were previously entered are still on this list.

4. This shows you the Product Tax Categories associated with this taxing jurisdiction. In our example it is Merchandise.

5. These are the Tax Category Tax Rates for the highlighted zipcode. In our example there are three tax rates:

WA State: 6.5%

WA King County: 2.2%

WA King Bellevue: 1.4%

So, a customer taking delivery of merchandise in Bellevue, WA will be charged a total of 10.1% sales tax.

6. This column shows all Tax Rates for the state of Washington, plus any that may have been added manually. You may use the arrows to move any of these tax rates to or from the Tax Category Tax Rates list.

Note: We recommend consulting your dealer, or POSitive support, before changing any Tax Rate imported from Zip2Tax.