A finance company is a third party billing option allowing you to transfer payment responsibility to an actual finance company or some other third party entity such as an employer providing matching funds.

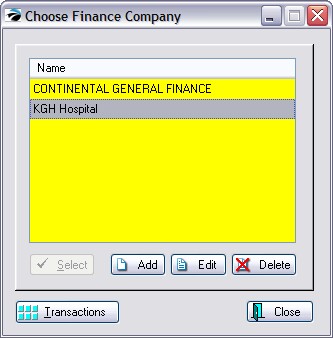

For Finance Company or Third Party Billing to work you must add Finance Companies to POSitive through Maintenance: Definitions: Lists: Finance Companies

Use the Add, Edit, or Delete* buttons as necessary. (see Finance Company Detail)

The Select button will be active only when appropriate to the task.

Transactions shows a list Of Finance Company charges

To Create a Finance Company Tender Definition

Go to Maintenance: Definitions: Tender

Make sure there is a Finance Company entry. Create one if needed. (see Tender)

INVOICING

To Invoice To a Finance Company

Choose Finance Company: Contact POSitive support for more information.

Create an invoice for a customer by name.

On the Tender Screen choose Finance Company

Select the appropriate company

Print the invoice.

AR STATEMENTS

To Bill A Finance Company

(see AR Statements)

Create An AR Statement for the finance company and mail it out. On the Finance Company record, one could choose to "Print Invoices With Statements" so that the finance company as full documentation of the charges.

To Accept Payment From A Finance Company

(see AR Payments)

Highlight the Finance Company in the Customer Center. Choose Take AR Payment and select the Finance Company. Follow the process.

Special Handling of Unpaid Charges

Some finance companies may never pay the charges in full. For example, the finance company may withhold a fee for their services or in the case of insurance companies will only pay a percentage of the full amount.

Once the finance company has paid as much as it will pay, there could still be charges still on the books of POSitive. You may have another solution, but we suggest that you create a credit card tender type which can be used to payoff those outstanding balances. The advantage is that you can run a report of how often that tender type has been used. (Report Center: Management Reports: Tender History Summary)