Manufacturer Coupon

Customers receive manufacturer coupons in the mail, in products, and in newspapers. As a store owner, you will want to honor the coupons and give customers the savings. Since you will be reimbursed for these coupons by the manufacturer, some states require that you tax the item on its original price before the coupon is applied. POSitive can automate this.

You may create as many Manufacturer coupons as you wish. These coupons will only be valid for specific products and POSitive will check the customer invoice for qualifying items.

To create a Manufacturer coupon be sure to UNCHECK the option "This Is A Store Coupon..."

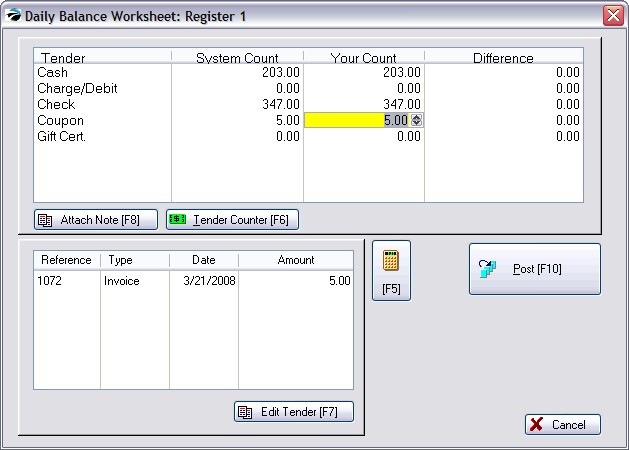

When you redeem these coupons, place them in the Cash Drawer. When you balance the Cash Drawer, the coupons will be tallied and must be balanced.

Store Coupon

In order to bring customers into the store, you may print coupons in the newspaper or distribute them in other ways. These coupons will be used to reduce the selling price of items. Unlike a manufacturer's coupon, you will not be reimbursed the coupon value, therefore you should not have to pay taxes on the higher selling price.

You may create as many Store coupons as you wish.

IMPORTANT: be sure to CHECK the option "This Is A Store Coupon..." and assign the coupon to a TAXABLE category.

When you redeem these coupons, they will not update the Coupon section of the Daily Balance Worksheet. Instead, you can run a report on the Administration: Coupons category to see of often they were redeemed.