| Show/Hide Hidden Text |

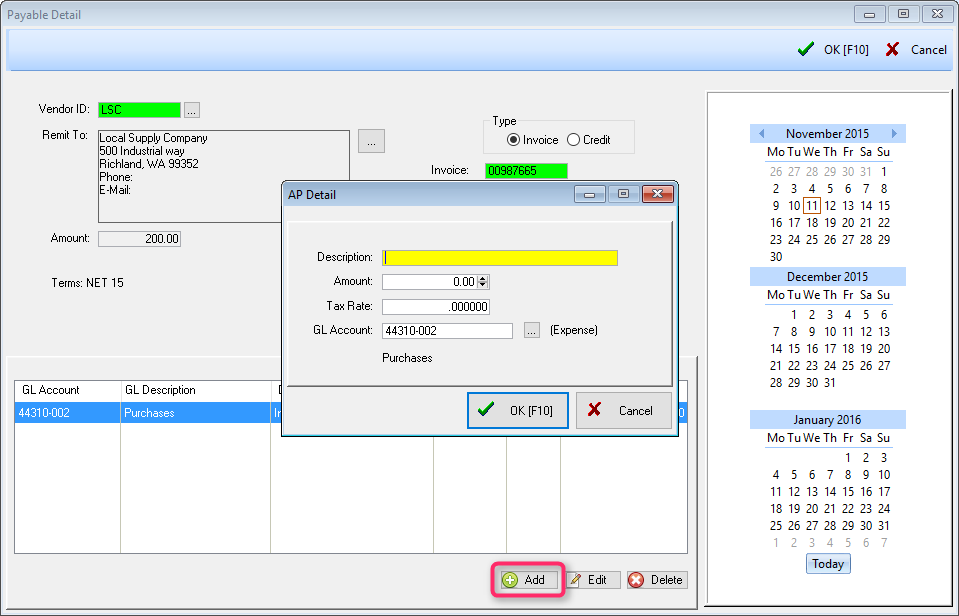

This screen is opened when you choose to manually add an AP Transaction to Accounts Payable - AP Unposted. (Accounting: AP Processing: ADD on the AP - Unposted view)

|

Some vendor charges, such as rent and phone bills, are not directly related to inventory and therefore are not added by processing a purchase order. Also, it is here that you enter credits which your vendor may grant you.

It is also possible, that through an oversight, a purchase order has not appeared here because the vendor term was not set to Post To Accounts Payable.

Fill in appropriate fields. The Amount and Total Tax fields are calculated for you as you choose the Add button to enter line transactions.

When manually creating an AP entry, POSitive will warn you if you are entering an invoice number which is already in the list. This suggests that someone has already entered the charges and you are about to make a duplicate entry. |

Click on Add to enter a line transaction with a description, amount, tax rate and GL Account.

Q: Is this GL expense account for the vendor required?

A: No, this can be left blank and is not required. This expense account is not assigned to the vendor, it represents the account value that will appear initially by default when you manually add an expense to AP.