Your expenses in running the business include purchase of products for resale. The primary purpose of Accounts Payable in POSitive is to properly track purchase orders received and payments to your vendors.

However, you have other vendors who provide services such as phone, rent, and loans. POSitive allows you to maintain those transactions as well by manually adding to the Accounts Payable section.

THINGS TO DO

| • | Add vendors. (see Vendors) |

| • | Become familiar with the stages of AP Processing (see Overview Accounts Payable) |

THINGS TO UNDERSTAND

Create the vendor, assigning it a vendor term which determines if transactions will be automatically posted to AP.

Process purchase orders

Review Pending AP and confirm payments to be made

Issue payments of AP

View AP per Vendor.

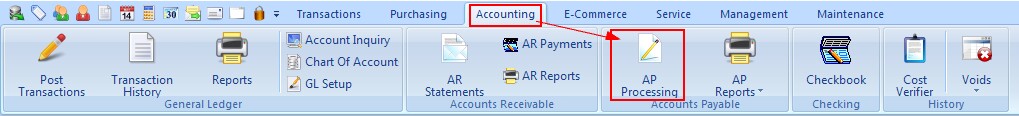

Access to Accounts Payable

Go to Accounting: Accounts Payable

Choose AP Processing

Accounts Payable Stages

AP - Unposted - these are transactions which are under review. Some are purchase orders which have not been finalized (In Process). Others are from purchase orders received, but final paperwork has not been reviewed. The purpose here is to review transactions from all or selected vendors. Once they are deemed accurate and payable they are "posted" to be paid. Included here are Credits from vendors which can be posted and used to offset payment totals.

AP - Posted - these are transactions which are approved for payment. They can be paid separately or in groups per vendor. There is an option to "UnPost" any transaction which does not look complete, thereby sending it back to "Unposted." Otherwise, transactions are tagged for payment and processed. Depending upon system setups, a check can be printed by POSitive or simply reported so that checks can be handwritten.

AP - History - once the transactions have been processed for payment, they can be reviewed as historical entries. These entries cannot be removed even if they are in error. Instead, one would post an offsetting entry of a credit.