A special procedure must be followed when creating a return for a purchase that was charged a surcharge. Failure to follow this procedure may result in too much money being refunded, and the return not being properly reported to the GL. Please schedule an appointment with the POSitive support department to have this feature setup for you.

Starting with the 2022.09.13 version you may designate a specific station for creating credit card sales without applying a surcharge. This special station is also to be used for processing returns for sales that were charged a surcharge. This section will describe how the process must be followed (you should be familiar with the return process in POSitive).

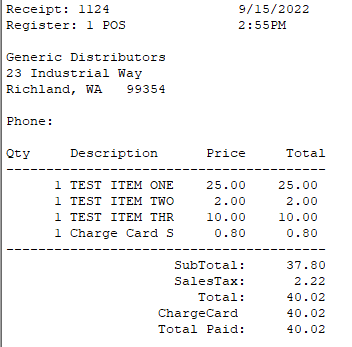

In this example we are creating a "partial return", which means we are not refunding the entire sale.

We are going to process a return for a single item on this receipt.

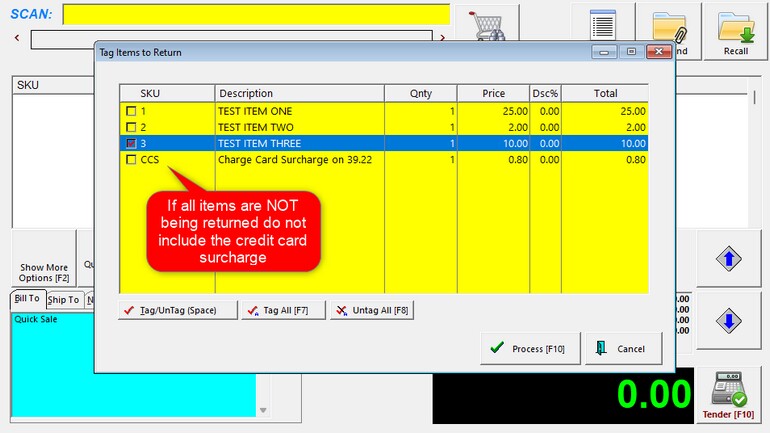

Start the return on the station designated for processing returns with surcharges and tag the merchandise item being returned. Do NOT include the surcharge because only a partial amount will be refunded.

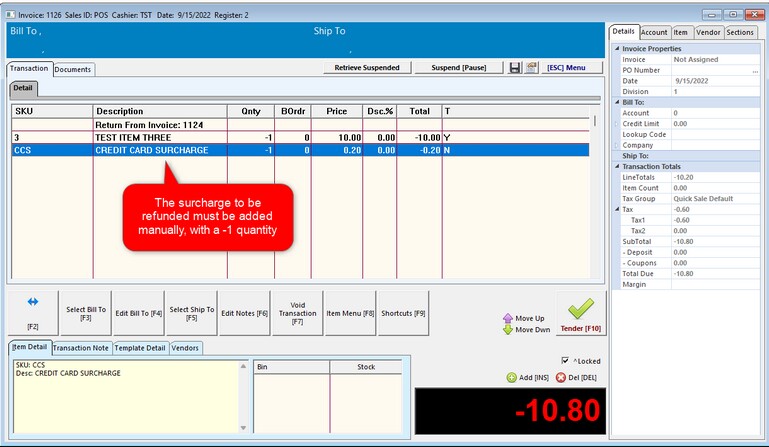

Because only a partial refund is being given, you must manually add the portion of the original credit card surcharge that will be refunded. This means you'll have to do some simple math. The easiest way to determine the amount of the surcharge is to multiply the the line totals by the amount of the surcharge. In our examples we've been using a 2% surcharge and on most calculators you may multiply 10.00 by 2%. For example, 10 x 2 % = 0.2 which is 20 cents. Another way is to multiply 10.00 by 0.02 which gives the amount of 0.2 or 20 cents. So, our total refund with sales tax will be $10.80. Click the Tender button when you are ready to continue.

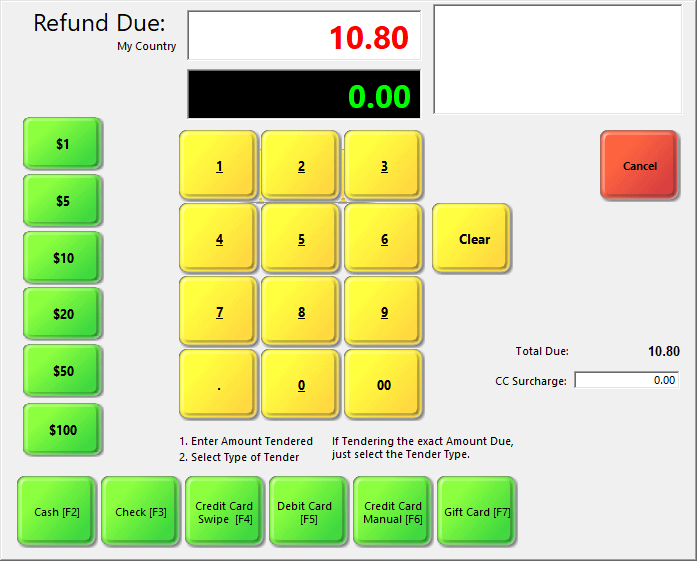

IMPORTANT: The credit card surcharge to be refunded is already included in the Refund Due and the CC Surcharge box should say 0.00. If it says otherwise, cancel and void the transaction and process the return on the station designed for processing returns with credit card surcharges. Otherwise you will refund too much money to the customer.

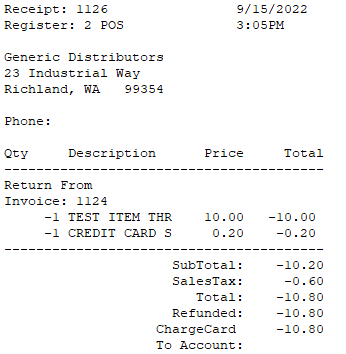

This is the customer receipt showing the amount refunded.