According to local and state taxation laws, you set tax rates for inventory and services sold. The tax rate is defined as a decimal number out to six place units. For example a tax rate of 7.8% is represented as .078000.

•You may Add, Edit,and Delete tax rates.

•Tax Rate Changes. If your locality has had a tax increase, simply edit the current tax rate and enter the new tax rate. The new rate will take effect immediately. Old invoices will not be changed.

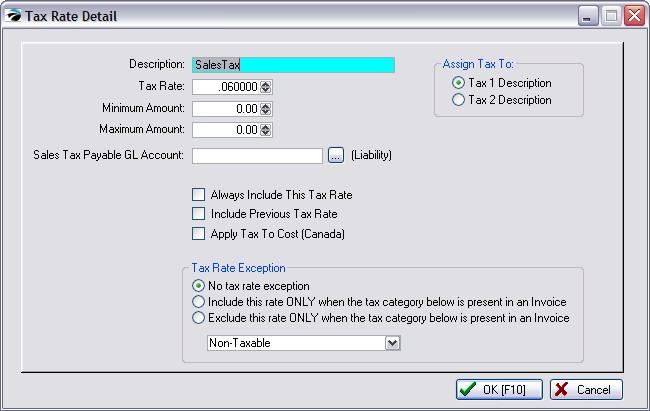

Below the All Tax Rates section (see Tax Setup), choose Add or Edit and you will see a screen similar to this one.

Description - A simple explanation such as Local Tax or Exempt or the name of county name.

Tax Rate - The percentage of tax expressed in a decimal format such as 7.8% would be 0.07800. Note: Do not type the leading zero, start with the decimal, .078

Minumum Amount - should ALWAYS be 0.00 unless you have a very unique tax structure.

Maximum Amount - should ALWAYS be 0.00 unless you have a very unique tax structure. (See Luxury Type Taxes described below.)

Sales Tax Payable GL Account- (Liability)

This is usually left blank. Contact POSitive support for more information.

The GL Interface Setup has already handled this. Only if you wish, you may track tax debits and credits in your General Ledger using the other GL Account numbers. Use the lookup button to the right to link to the appropriate GL Account number.

-- Assign Tax To --

On an invoice there are two fields reserved for displaying sums of taxes being charged. Indicate which field, tax 1 or tax 2, that this tax will be assigned to.

•Tax 1 Description - Generally, you will always select Tax 1.

•Tax 2 Description - Could be used for City Tax, GST or PST, or other tax.

NOTE: The following options should be left unchecked. Please check with your dealer for specific uses.

•Always Include This Tax Rate - (always leave this unchecked - special use only)

•Include Previous Tax Rate - only used to charge tax on a previously calculated tax

•Apply Tax To Cost (Canada) - this is a VAT tax.

Tax Rate Exception

Please check with your dealer for specific uses.

•No tax rate exception (Recommended)

•Include this rate ONLY when the tax category below is present in an Invoice.

•Exclude this rate ONLY when the tax category below is present in an Invoice.

[Select Name of Tax Category]