| Show/Hide Hidden Text |

If you are not using Touchscreen to redeem Loyalty Points (see Redeem Frequent Buyer Awards) then this is an alternate method you could use.

Advanced Setup

Add Button "Redeem Points" To Invoice Button Bar

Create Item "Use Points" non-taxable, no track stock sample

|

Create Invoice

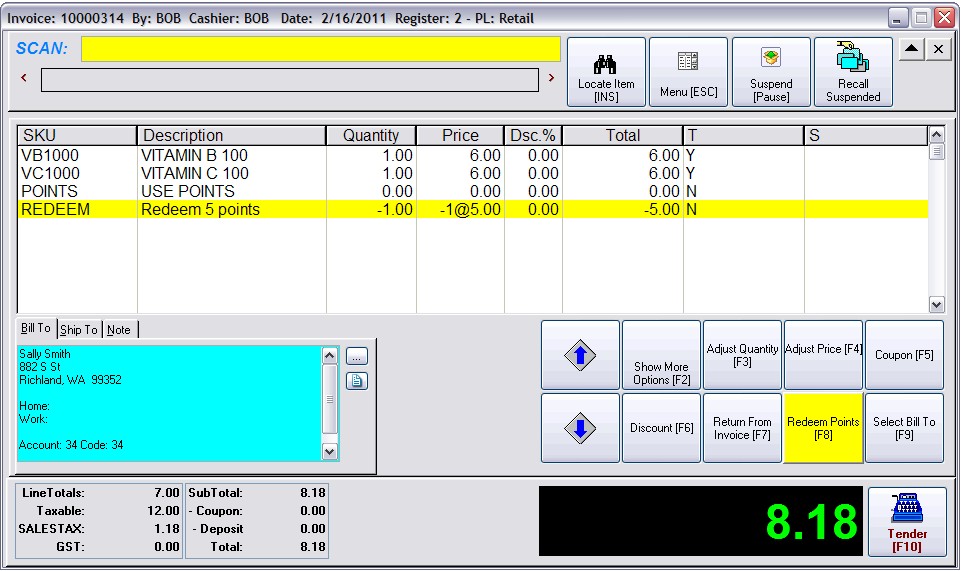

Add Items being purchased

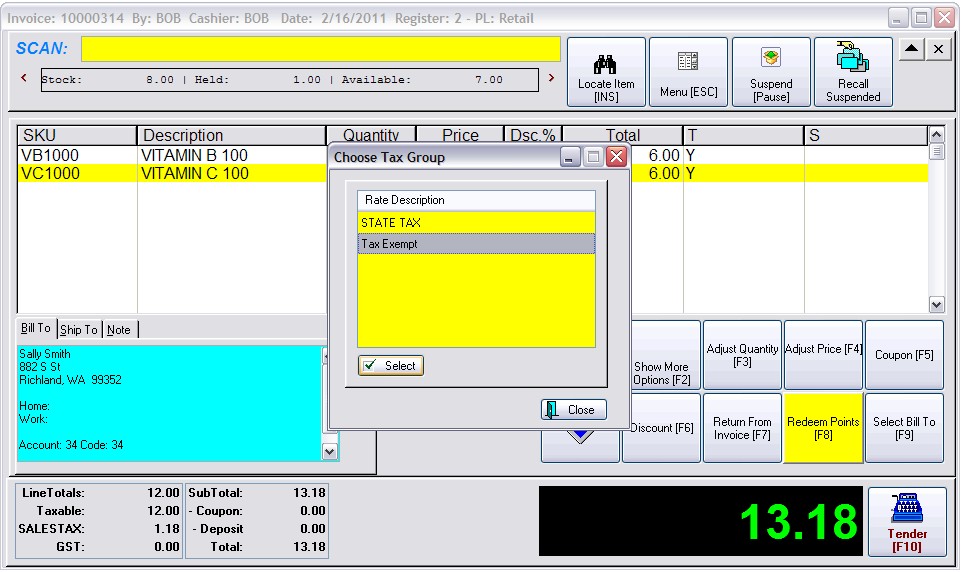

Add NO TAXATION - CTRL-Y - Select Tax Exempt

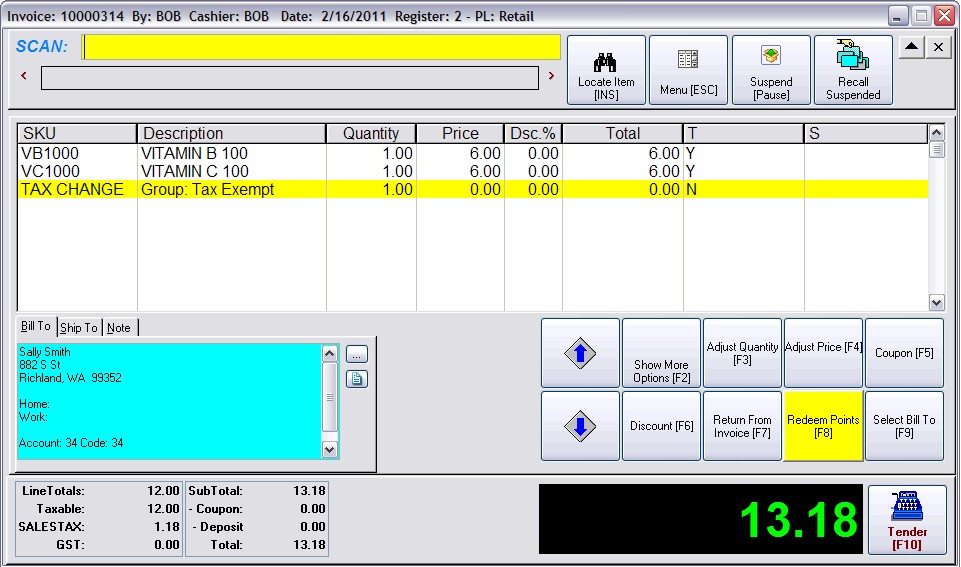

This will create a Tax Change Line on the invoice which can be removed later. The intent is to ensure that the customer pays taxes.

Choose To Use Points

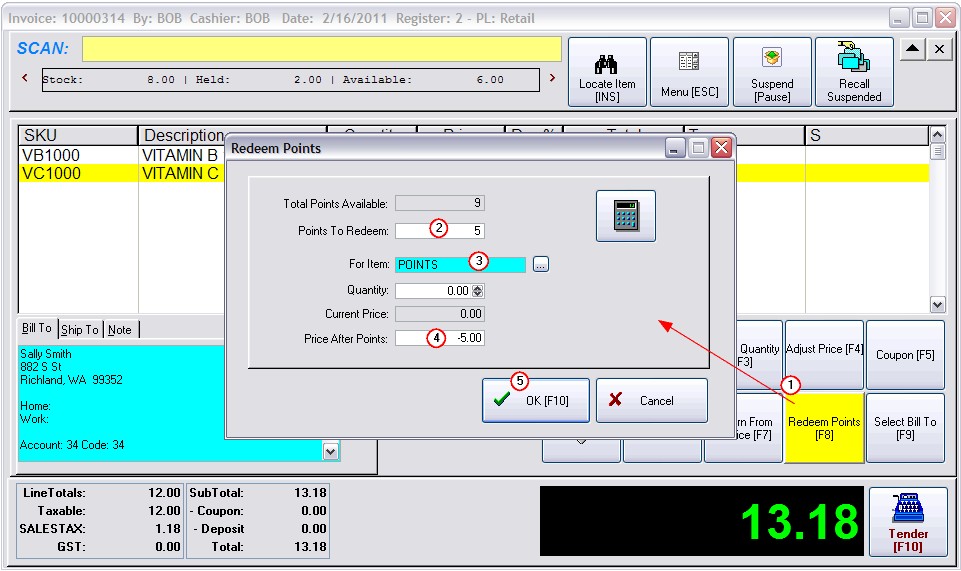

1) Select Redeem Points button

2) Enter the number of points to be used

3) Enter the SKU

4) Enter the discount value in the Price After Points field. Use a minus sign with the dollar amount

5) Choose OK [F10]

The points are deducted, however there are some extra lines which can be removed before processing the invoice.

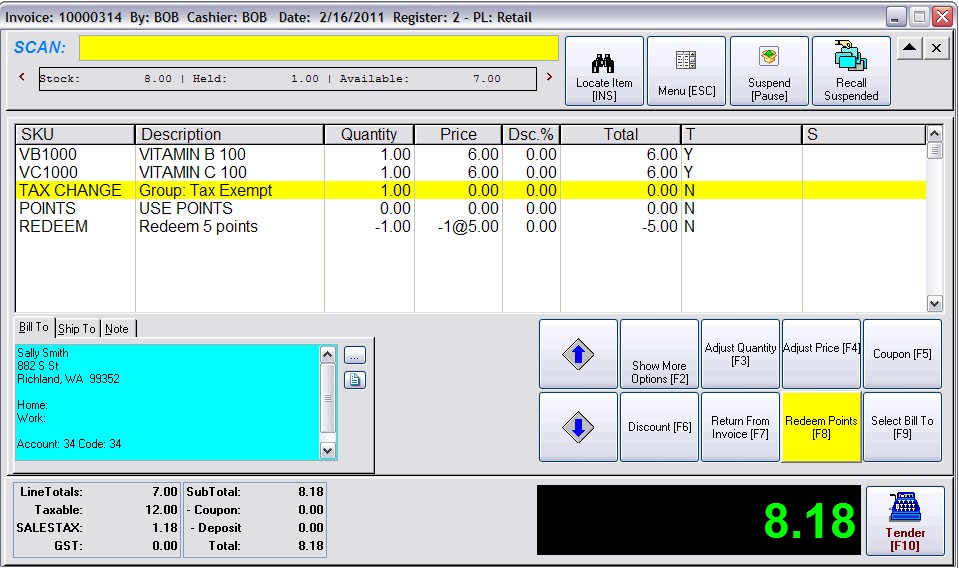

The customer has purchased $12.00 in product with a tax value of $1.18.

We have reduced the invoice by $5.00 by using the points and reduced the points earned by 5. The tax of $1.18 is still being charged.

You can Tender the invoice as it is. Or you may wish to remove extra lines to make the invoice look cleaner.

Removing lines will make the invoice look cleaner, but you are limiting yourself in the types of reports which can be run after the fact. For example, you will not be able to report on all invoice which have the USE POINTS line if you delete it from the invoice.

OPTIONAL DELETIONS

Remove the TAX CHANGE line by highlighting it and pressing the DELete button on the keyboard.

(Be sure to leave the REDEEM line on the invoice.)

Optional - Remove the POINTS line by highlighting it and pressing the DELete button on the keyboard

(Be sure to leave the REDEEM line on the invoice.)