Scenario: a customer brings something back which is not working

-- because it is out of warranty, you have to check with the vendor before issuing a credit

-- take the item back as a return, but issue a Pending Gift Card as a refund

Even if you have never used gift cards, the system can handle this for you. It will place the credit in Gift Card Manager. You will not give the card to the customer. Instead, on the receipt indicate that the credit amount is pending authorization from the vendor / manufacturer

Eventually the Gift Card can be applied to the customer's AR or simply deleted.

Steps

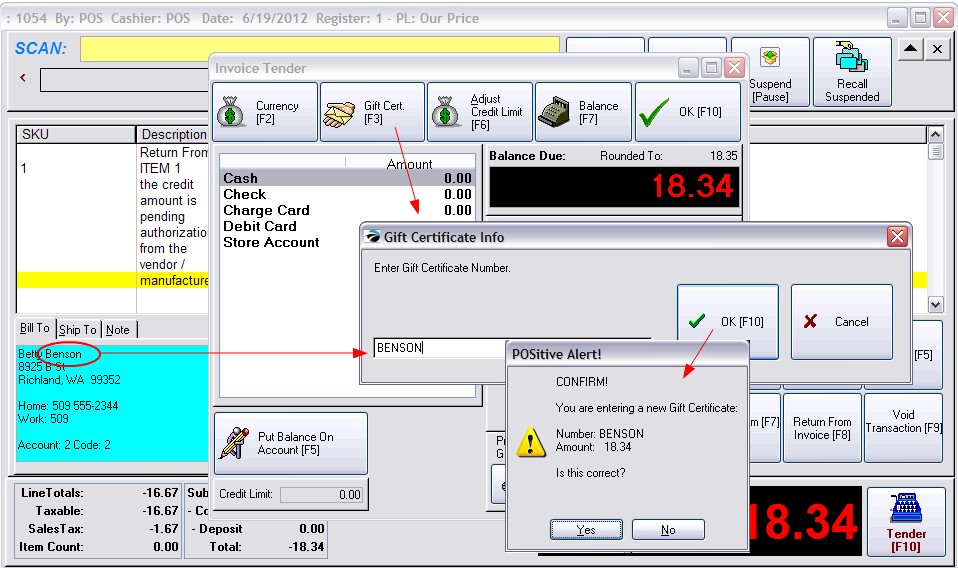

1) create a Return Invoice for the customer

2) choose Return and find the item on the original invoice

3) create a note (Ctrl-N) to indicate that the credit amount is pending authorization from the vendor / manufacturer

4) choose to Tender the invoice

5) select a Reason for Return and Action (probably "do not return to stock")

6) when prompted for how you want to refund monies, choose Gift Certificate [F3] at the top.

7) you will be asked to enter a card number. It could the last name of the customer

8) choose OK and complete the invoice.

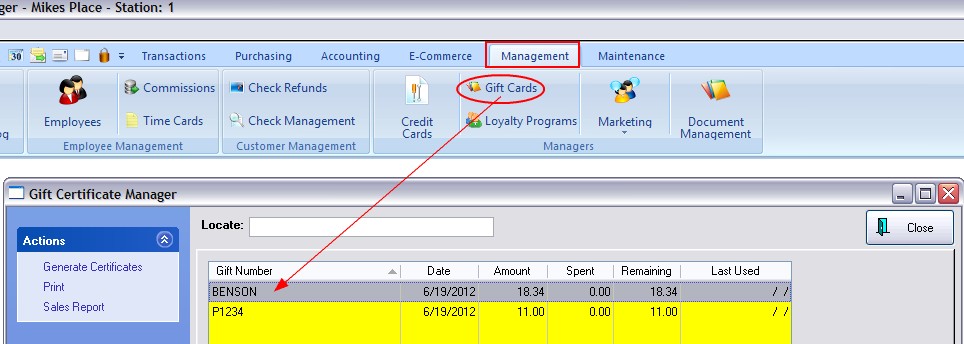

The Gift Certificate is stored in Management: Gift Cards

There are several ways to use the Gift Card

- delete it - WARNING: GL will be adversely affected if you do not compensate for it.

- hand it to the customer

- use it in payment towards a purchase

- apply it as a deposit on a pending order

- apply it as a Payment on AR either in payment of outstanding charges or as an Advanced Pay (Unapplied Credit)